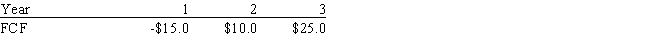

Ryan Enterprises forecasts the free cash flows (in millions) shown below.The weighted average cost of capital is 13.0%,and the FCFs are expected to continue growing at a 5.0% rate after Year 3.What is the firm's total corporate value,in millions?

A) $268.01

B) $196.22

C) $217.75

D) $272.79

E) $239.29

Correct Answer:

Verified

Q62: Francis Inc.'s stock has a required rate

Q64: Sorenson Corp.'s expected year-end dividend is D1

Q65: The Francis Company is expected to pay

Q66: Based on the corporate valuation model,Gray Entertainment's

Q70: Based on the corporate valuation model,the total

Q71: The Isberg Company just paid a dividend

Q73: Rebello's preferred stock pays a dividend of

Q75: Based on the corporate valuation model,Morgan Inc.'s

Q77: Goode Inc.'s stock has a required rate

Q78: Gupta Corporation is undergoing a restructuring,and its

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents