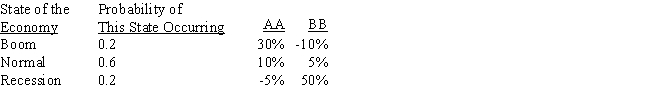

The distributions of rates of return for Companies AA and BB are given below:

We can conclude from the above information that any rational,risk-averse investor would be better off adding Security AA to a well-diversified portfolio over Security BB.

Correct Answer:

Verified

Q3: Market risk refers to the tendency of

Q6: Someone who is risk averse has a

Q10: Managers should under no conditions take actions

Q11: Risk-averse investors require higher rates of return

Q22: A firm can change its beta through

Q28: Under the CAPM, the required rate of

Q32: A stock's beta measures its diversifiable risk

Q39: The CAPM is built on historic conditions,

Q40: Even if the correlation between the returns

Q71: Because of differences in the expected returns

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents