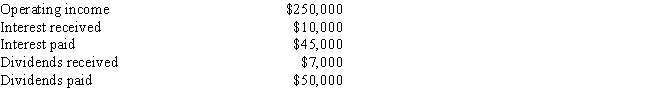

Your corporation has the following cash flows:  If the applicable income tax rate is 40% (federal and state combined) ,and if 70% of dividends received are exempt from taxes,what is the corporation's tax liability?

If the applicable income tax rate is 40% (federal and state combined) ,and if 70% of dividends received are exempt from taxes,what is the corporation's tax liability?

A) $87,708

B) $86,840

C) $72,077

D) $96,392

E) $71,209

Correct Answer:

Verified

Q93: Your corporation has a marginal tax rate

Q94: Vasudevan Inc.recently reported operating income of $4.80

Q95: Hartzell Inc.had the following data for 2014,in

Q96: During 2015,Bascom Bakery paid out $33,525 of

Q97: Scranton Shipyards has $7.0 million in total

Q99: Brown Office Supplies recently reported $19,500 of

Q100: Lovell Co.purchased preferred stock in another company.The

Q101: A company with a 15% tax rate

Q102: A corporation recently purchased some preferred stock

Q103: A corporate bond currently yields 8.20%.Municipal bonds

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents