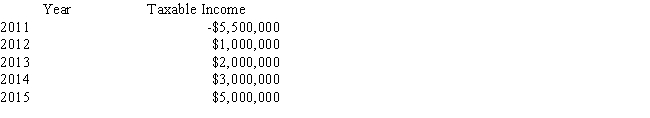

Appalachian Airlines began operating in 2011.The company lost money the first year but has been profitable ever since.The company's taxable income (EBT) for its first five years is listed below.Each year the company's corporate tax rate has been 40%.  Assume that the company has taken full advantage of the Tax Code's carry-back,carry-forward provisions and that the current provisions were applicable in 2011.How much did the company pay in taxes in 2014?

Assume that the company has taken full advantage of the Tax Code's carry-back,carry-forward provisions and that the current provisions were applicable in 2011.How much did the company pay in taxes in 2014?

A) $202,000

B) $200,000

C) $184,000

D) $154,000

E) $174,000

Correct Answer:

Verified

Q111: Watson Oil recently reported (in millions)$8,250 of

Q112: Last year,Stewart-Stern Inc.reported $11,250 of sales,$4,500 of

Q113: For 2015,Bargain Basement Stores reported $11,500 of

Q114: Carter Corporation has some money to invest,and

Q115: A 7-year municipal bond yields 4.8%.Your marginal

Q117: Solarcell Corporation has $20,000 that it plans

Q118: Garner Grocers began operations in 2012.Garner has

Q119: A corporation can earn 7.5% if it

Q120: Allen Corporation can (1)build a new plant

Q121: Moose Industries faces the following tax schedule:

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents