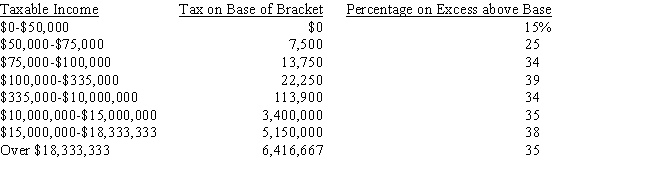

Last year,Martyn Company had $260,000 in taxable income from its operations,$50,000 in interest income,and $100,000 in dividend income.Using the corporate tax rate table given below,what was the company's tax liability for the year?  Assume a 70% dividend exclusion for tax on dividends.

Assume a 70% dividend exclusion for tax on dividends.

A) $115,600

B) $134,096

C) $139,876

D) $119,068

E) $95,948

Correct Answer:

Verified

Q125: Griffey Communications recently realized $102,500 in operating

Q126: Mays Industries was established in 2010.Since its

Q127: Uniontown Books began operating in 2011.The company

Q128: Maureen Smith is a single individual.She claims

Q129: Maureen Smith is a single individual.She claims

Q131: Alan and Sara Winthrop are a married

Q132: Alan and Sara Winthrop are a married

Q133: Alan and Sara Winthrop are a married

Q134: Maureen Smith is a single individual.She claims

Q135: Lintner Beverage Corp.reported the following information from

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents