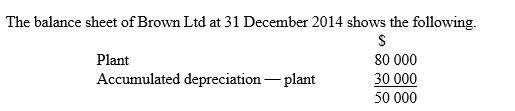

On 1 January 2015, based on a valuer's estimate of fair value, it was decided to revalue the plant to $65 000. The plant was then assessed to have a further useful life of 5 years and an expected residual amount of $5000. What is the journal entry in the books of Brown Ltd to record depreciation on plant on a straight-line basis for the half-year ending 30 June 2015 (balance date) ?

On 1 January 2015, based on a valuer's estimate of fair value, it was decided to revalue the plant to $65 000. The plant was then assessed to have a further useful life of 5 years and an expected residual amount of $5000. What is the journal entry in the books of Brown Ltd to record depreciation on plant on a straight-line basis for the half-year ending 30 June 2015 (balance date) ?

A) Depreciation expense - plant 12 000 Accumulated depreciation- plant 12 000

B) Depreciation expense - plant 6 000 Accumulated depreciation - plant 6 000

C) Accumulated depreciation - plant 6 000 Depreciation expense - plant 6 000

D) Depreciation expense - plant 6 500 Accumulated depreciation- plant 6 500

Correct Answer:

Verified

Q1: Under the accounting standard dealing with revaluations,

Q2: What is the basic accounting entry for

Q3: Accounting standard IAS 16/AASB 116 requires what

Q5: Accounting standard IAS 16/AASB 116:

A) requires all

Q6: Revaluations that occur must be upward or

Q7: In accounting standard IAS 16/AASB 116 a

Q8: How many of these are requirements

Q9: FK Ltd's fleet of delivery trucks (original

Q10: On 31 December 2014 Millwood Ltd's balance

Q11: Which of these terms have the same

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents