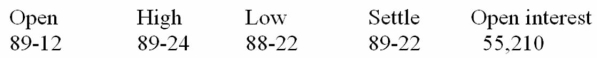

You find the following current quote for the March T-Bond contract: $100,000; Pts 32nd, of 100%  You went long in the contract at the open. Which of the following is/are true?

You went long in the contract at the open. Which of the following is/are true?

I. At the end of the day, your margin account would be increased.

II. 55,210 contracts were traded that day.

III. You agreed to deliver $100,000 face value T-Bonds in March in exchange for $89,120.

IV. You agreed to purchase $100,000 face value T-Bonds in March in exchange for $89,375.

A) I, II, and III only

B) I, II, and IV only

C) I and III only

D) I and IV only

E) IV only

Correct Answer:

Verified

Q2: A negotiated non-standardized agreement between a buyer

Q21: A speculator may write a put option

Q25: You have taken a stock option position

Q27: An interest rate collar is

A) writing a

Q27: In a bear market,which option positions make

Q31: A bank with long-term fixed-rate assets funded

Q34: New futures contracts must be approved by

A)the

Q36: A bank with short-term floating-rate assets funded

Q37: The higher the exercise price,the _ the

Q39: You have taken a stock option position

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents