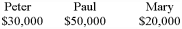

When Peter gave notice to Paul and Mary of dissolution of their entertainment partnership business,the capital accounts were as follows: The partnership assets were liquidated to $30,000.Outstanding liabilities to third parties totalled $39,000.Distributed to Peter,Paul,and Mary,each will respectively receive

A) $20,000,$30,000,$50,000.

B) $27,000,$47,000,$17,000.

C) $27,000,$45,000,$18,000.

D) $30,000,$50,000,$20,000.

E) $28,500,$41,250,$16,000.

Correct Answer:

Verified

Q14: While an agent is travelling in Northern

Q49: Limited partners may actively participate in the

Q51: When one joins an existing partnership, care

Q52: To the extent that there is no

Q54: A limited partner who allows his or

Q59: Set out the terms and provisions that

Q79: In March,Kemal entered into an agreement with

Q82: Limited partnerships are generally subject to specific

Q85: An income trust is

A)an investment where ownership

Q86: Where an agent enters a contract,not under

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents