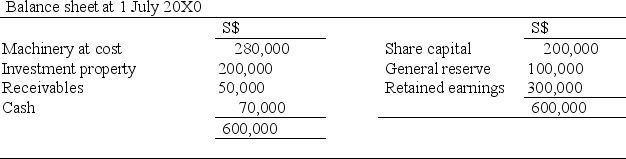

Aussie Ltd acquired 100% of Sing Sing Ltd (Sing Sing) on 1 July 20X0. The balance sheet of Sing Sing on that date was as follows:

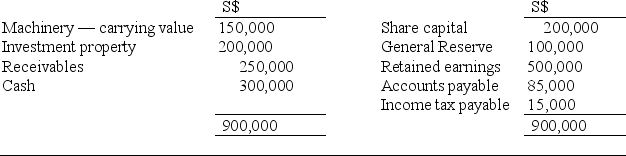

The balance sheet of Sing Sing as at is as follows:

Balance sheet as at 30 June 20X1

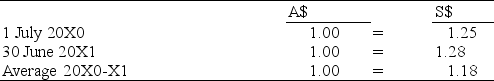

Relevant exchange rates are as follows:

If the local currency of Sing Sing is Singapore dollars and the functional currency is Australian dollars the total assets of S$900,000 would translate into Australian dollars as:

A) $703 125.

B) $709 688.

C) $1 141 500.

D) $1 152 000.

Correct Answer:

Verified

Q5: Aussie Ltd has an investment in Yankee

Q8: If foreign currency denominated non-monetary items are

Q11: Post-acquisition date retained earnings that are denominated

Q11: The general rule for translating liabilities denominated

Q12: Aussie Ltd acquired 100% of Sing Sing

Q13: According to AASB 121 The Effects of

Q15: Differences arise in relation to the treatment

Q18: According to AASB 121 The Effects of

Q19: When translating into the functional currency foreign

Q20: When translating into the presentation currency the

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents