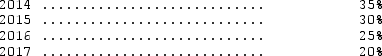

Rodeo Corporation reported depreciation of $450,000 on its 2014 tax return.However,in its 2014 income statement,Rodeo reported depreciation of $300,000,as well as $30,000 interest revenue on tax-free bonds.The difference in depreciation is only a temporary difference,and it will reverse equally over the next three years.Rodeo's enacted income tax rates are as follows:  What amount should be included in the deferred income tax liability in Rodeo's December 31,2014,balance sheet?

What amount should be included in the deferred income tax liability in Rodeo's December 31,2014,balance sheet?

A) $52,500

B) $45,000

C) $30,000

D) $37,500

Correct Answer:

Verified

Q52: Which of the following is an example

Q53: Bodner Corporation's income statement for the year

Q54: Which of the following is NOT a

Q55: Alpha had taxable income of $1,500 during

Q56: Which of the following represents a permanent

Q58: For the current year,Southern Cross Company reported

Q59: In computing the change in deferred tax

Q60: Which of the following could never be

Q61: Seymour Associates computed a pretax financial income

Q62: Pretax accounting income is $100,000 and the

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents