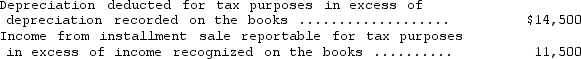

The books of the Speedster Company for the year ended December 31,2014,showed pretax income of $295,000.In computing the taxable income for federal income tax purposes,the following timing differences were taken into account:  What should Speedster record as its current federal income tax liability at December 31,2014,assuming a corporate income tax rate of 30 percent?

What should Speedster record as its current federal income tax liability at December 31,2014,assuming a corporate income tax rate of 30 percent?

A) $80,700

B) $84,700

C) $87,600

D) $89,400

Correct Answer:

Verified

Q44: Which of the following is an example

Q45: Creative Corporation's income statement for the year

Q46: For the current year,Phoenix Company reported income

Q47: Tongass had pretax accounting income of $1,400

Q48: During 2014,Epsilon Company had pretax accounting income

Q50: Intraperiod tax allocation

A) involves the allocation of

Q51: For the current year,Eastern Atlantic Company reported

Q52: Which of the following is an example

Q53: Bodner Corporation's income statement for the year

Q54: Which of the following is NOT a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents