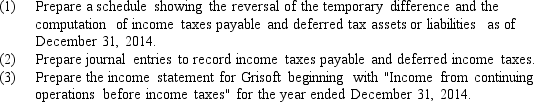

Grisoft Inc.computed a pretax financial income of $40,000 for the first year of its operations ended December 31,2014.Analysis of the tax and book basis of its liabilities disclosed $360,000 in unearned rent revenue on the books that had been recognized as taxable income in 2014 when the cash was received.

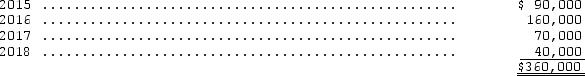

The unearned rent is expected to be recognized on the books in the following pattern:

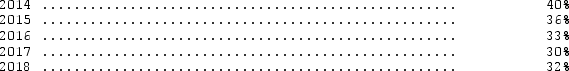

The enacted tax rates for this year and the next four years are as follows:

The enacted tax rates for this year and the next four years are as follows:

Use the provisions of FASB Statement No.109.

Use the provisions of FASB Statement No.109.

Correct Answer:

Verified

Q58: For the current year,Southern Cross Company reported

Q59: In computing the change in deferred tax

Q60: Which of the following could never be

Q61: Seymour Associates computed a pretax financial income

Q62: Pretax accounting income is $100,000 and the

Q64: Allsgood Appliances computed a pretax financial loss

Q65: Smart Services computed pretax financial income of

Q66: The following differences between financial and taxable

Q67: The data shown below represent the complete

Q68: Oriole Industries computed a pretax financial income

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents