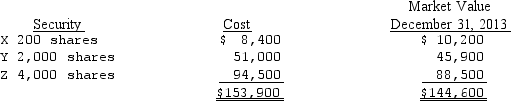

During 2013,Rubble Company purchased marketable equity securities as a short-term investment and classified them as trading securities.The cost and market value at December 31,2013,were as follows:  Rubble sold 1,000 shares of Company Y stock on March 16,2014,for $24 per share,incurring $1,300 in brokerage commissions and taxes.On the sale,Rubble should report a realized loss of

Rubble sold 1,000 shares of Company Y stock on March 16,2014,for $24 per share,incurring $1,300 in brokerage commissions and taxes.On the sale,Rubble should report a realized loss of

A) $0.

B) $1,550

C) $2,300

D) $2,800

Correct Answer:

Verified

Q44: In January of 2014,Bonnie Corporation acquired 20%

Q45: On August 31,2014,Steinway Company purchased the following

Q46: On October 1,Ryan Company purchased $200,000 face

Q47: Neutron Corporation held the following short-term investments

Q48: Ignoring income taxes,choose the correct response below

Q50: Eric Company reports its income from its

Q51: Other-than-temporary impairments in the value of equity

Q52: Aloe Company reports its income from its

Q53: The market rate of interest for a

Q54: When an investor purchases sufficient common stock

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents