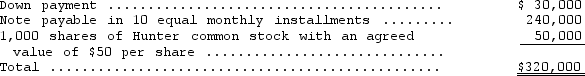

In January,Fanning Corporation entered into a contract to acquire a new machine for its factory.The machine,which had a cash price of $400,000,was paid for as follows:  Prior to the machine's use,installation costs of $10,000 were incurred.The machine has an estimated useful life of ten years and an estimated salvage value of $10,000.What should Hunter record as depreciation expense for the first year under the straight-line method?

Prior to the machine's use,installation costs of $10,000 were incurred.The machine has an estimated useful life of ten years and an estimated salvage value of $10,000.What should Hunter record as depreciation expense for the first year under the straight-line method?

A) $38,100

B) $39,100

C) $40,000

D) $41,000

Correct Answer:

Verified

Q26: Hyde Company traded in an old machine

Q27: A company using the group depreciation method

Q28: Mantle Company exchanged a used autograph-signing machine

Q29: Underwood Company purchased a machine on January

Q30: Stanley Company purchased a machine that was

Q32: Stiller Company owns a machine that was

Q33: Lex Soaps purchased a machine on January

Q34: On January 1,2014,Ashton Company purchased equipment at

Q35: Meteor Motor Sales exchanged a car from

Q36: On January 1,2012,Costas Co.purchased a new machine

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents