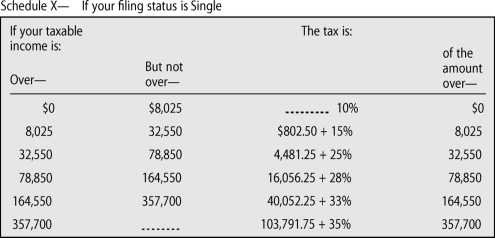

Janine rented an apartment for $900 a month.After a year,she bought a house with a monthly mortgage of $1,250.At the end of the year,she is able to deduct $4,900 in real estate taxes and $8,400 in interest.Janine's taxable income is $42,000.Using the tax schedule below,how much was she able to save on her taxes due to her home ownership?

A) $2,940.00

B) $3,101.25

C) $3,903.75

D) $6,843.75

Correct Answer:

Verified

Q8: Tax tables list taxable income in intervals.

Q9: Income tax is paid on earned income

Q10: Roland had $10,500 in medical expenses last

Q11: The long form,also called a 1040,is the

Q12: The Mancuso family consists of five children,two

Q14: Look at the W-2 below.What is the

Q15: A W-2 is an income statement that

Q16: John and Loretta Smith are in the

Q17: In a progressive tax system,taxes decrease as

Q18: Lynn is a single mother with two

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents