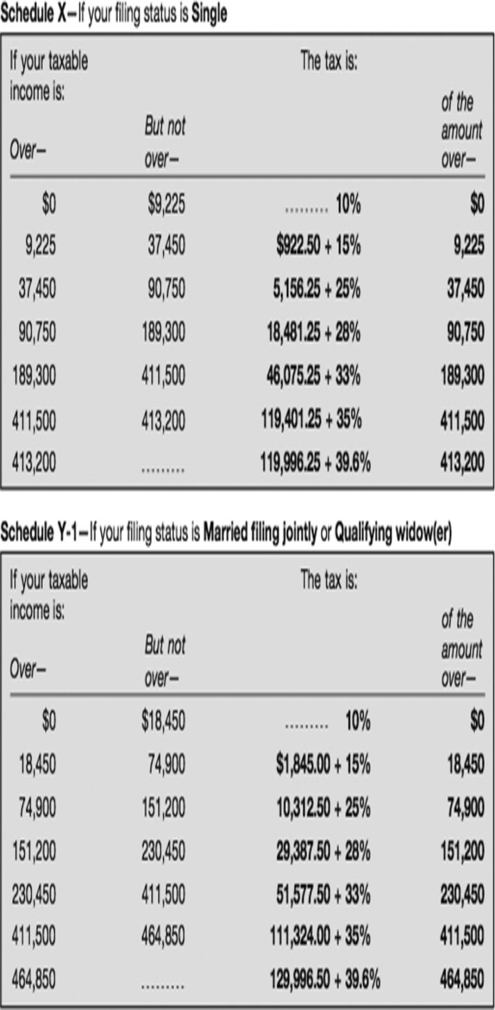

Jason and Lina are trying to decide whether they should get married in December or January.They have heard that there is a marriage penalty built into the federal tax system.If Jason has taxable income of $150,000 and Lina has taxable income of $90,000,determine whether they should file as single and get married in January,or move the wedding up to December so that they can file jointly.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q26: Abraham is a single taxpayer with no

Q27: A single mother who files head of

Q28: Maria and Juan are married,filing jointly.Their taxable

Q29: Benjamin started a new job and wants

Q30: Chris's taxable income is $60,709.She is married,filing

Q32: Brittany's W-2 reported total Medicare withholding based

Q33: Tanika is filing single and has a

Q34: Cody filed as a single taxpayer and

Q35: Nancy does her taxes herself.She filled out

Q36: Asa is single and had taxable income

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents