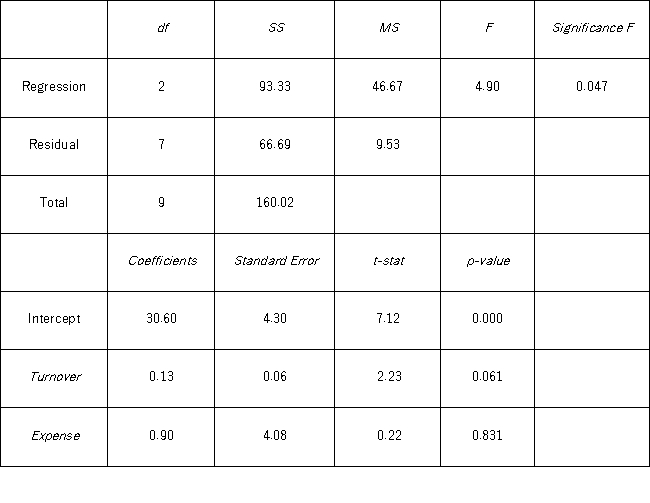

An investment analyst wants to examine the relationship between a mutual fund's return,its turnover rate,and its expense ratio.She randomly selects 10 mutual funds and estimates: Return = β0 + β1Turnover + β2Expense + ε,where Return is the average five-year return (in %),Turnover is the annual holdings turnover (in %),Expense is the annual expense ratio (in %),and ε is the random error component.A portion of the regression results is shown in the accompanying table.  a.At the 10% significance level,are the explanatory variables jointly significant in explaining Return? Explain.

a.At the 10% significance level,are the explanatory variables jointly significant in explaining Return? Explain.

b.At the 10% significance level,is each explanatory variable individually significant in explaining Return? Explain.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q105: Which of the following statements in statistical

Q108: Consider the following regression results based on

Q109: Which of the following is the correct

Q110: When estimating a multiple regression model based

Q111: A sociologist estimates the regression relating Poverty

Q112: In a multiple regression based on 30

Q115: A manager at a local bank analyzed

Q116: Assume you ran a multiple regression to

Q117: Consider the following regression results based on

Q118: A marketing manager examines the relationship between

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents