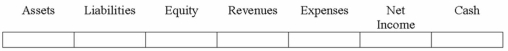

An asset purchased for $12,000 with a $3,000 salvage and a 5 year life is depreciated using straight line depreciation for two years. At the beginning of the third year the useful life of the asset is revised to 4 years. Show how the revision of depreciation expense in the third year of the asset's life will affect the financial statements (compared to the financial statements if the revision in estimate had not been made).

Correct Answer:

Verified

Explanation:...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q2: What is meant by a "basket purchase,"

Q5: Name three examples of property,plant and equipment.

Q12: Explain how the gain or loss is

Q14: Why is land classified separately from other

Q15: Give an example of a type of

Q32: What is the name of the tax

Q110: On May 16, 2013, Twin Peaks Corporation

Q113: The Baird Company paid $4,500 to extend

Q115: The Byer Company purchased the Cellar Company

Q116: The Jenkins Company purchased equipment for $15,000

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents