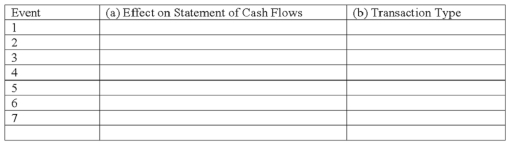

The following transactions apply to Kent Company.

1) Issued common stock for $21,000 cash

2) Provided services to customers for $28,000 on account

3) Purchased land for $18,000 cash

4) Incurred $9,000 of operating expenses on account

5) Collected $15,000 cash from customers for services provided in event #2

6) Paid $7,000 on accounts payable

7) Paid $2,500 dividends to stockholders

Required:

a) Identify the effect on the Statement of Cash Flows, if any, for each of the above transactions. Indicate whether each transaction involves operating, investing, or financing activities and the amount of increase or decrease.

b) Classify the above accounting events into one of four types of transactions (asset source, asset use, asset exchange, claims exchange).

Correct Answer:

Verified

Q123: Creighton Company accrued $120 of interest expense.

Q124: In a company's annual report, the reader

Q125: Danielle McLynn started a consulting business, McLynn

Q126: Patterson Company was founded in 2013 and

Q127: Which of the following events involves a

Q129: Using the form below, record each of

Q130: Tuttle Company shows the following transactions for

Q131: Jerry Mathers started his business by issuing

Q132: The entry to recognize depreciation expense incurred

Q133: Crosby Company recorded $3,000 of depreciation expense

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents