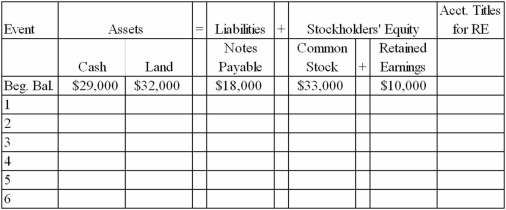

At the beginning of 2012, Gratiot Company's accounting records had the general ledger accounts and balances shown in the table below. During 2012, the following transactions occurred:

1. received $95,000 cash for providing services to customers

2. paid salaries expense, $50,000

3. purchased land for $12,000 cash

4. paid $4,000 on note payable

5. paid operating expenses, $22,000

6. paid cash dividend, $2,500

Required:

a) Record the transactions in the appropriate general ledger accounts. Record the amounts of revenue, expense, and dividends in the retained earnings column. Provide appropriate titles for these accounts in the last column of the table.  b) What is the amount of total assets as of December 31, 2012?

b) What is the amount of total assets as of December 31, 2012?

c) What is the amount of total stockholders' equity as of December 31, 2012?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q3: What is meant by the term double-entry

Q6: What is meant by the term "global

Q14: What is meant by the term "stakeholders?"

Q121: Classify each of the following events as

Q122: The following transactions apply to Warren Fitness

Q124: The transactions listed below apply to Lovell

Q125: Indicate whether each of the following statements

Q126: Jarvis Company experienced the following events during

Q127: Stinespring Company was founded in 2012. It

Q128: Each of the following requirements is independent

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents