Accrual return on investment versus cash flows

The Flinders Island Airways Pty Ltd is planning a project that is expected to last for six years. During that time, the project is expected to generate net cash inflows of $75 000 per annum.

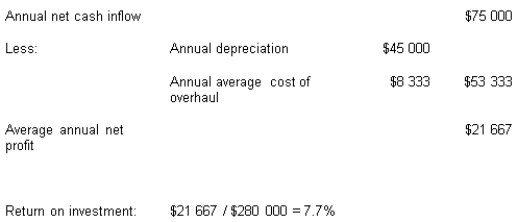

The project will require the purchase of a machine for $280 000. This new machine is expected to have a salvage value of $10 000 at the end of six years. In addition to its annual operating costs, the machine will require an overhaul costing $50 000 at the end of the fourth year. The company presently has a minimum desired rate of return of 12 per cent. Based on this information, the accountant prepared the following analysis:

Therefore, the accountant recommends that the project be rejected, as it does not meet the company's minimum desired rate of return.

i. What criticism(s) would you make of the accountant's evaluation of the project?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q98: When managers use a discounted cash flow

Q99: Which of the following statements is incorrect?

A)

Q100: When firms are analysing a capital investment

Q101: Conflict between discounted cash flow (DCF) analysis

Q102: The payback method

The payback method is a

Q104: Which of the following costs would not

Q105: Net present value analysis

The City of Geelong's

Q106: Which of the following benefits are likely

Q107: Importance of time value of money

A friend

Q108: Post-audits

i. What is a post-audit of a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents