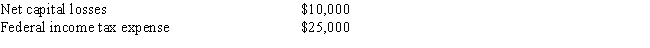

For 2014, the Beech Corporation has net income on its books of $60,000, including the following items: Federal tax depreciation exceeds the depreciation deducted on the books by $5,000. What is the corporation's taxable income?

A) $66,000

B) $85,000

C) $90,000

D) $103,000

E) None of the above

Correct Answer:

Verified

Q9: Which of the following is true with

Q34: The Nandina Corporation was formed and began

Q35: Which of the following companies is taxed

Q37: A corporation may be found subject to

Q45: As a general rule, the transfer of

Q53: S corporations pay taxes at a higher

Q57: If a corporation's status as an S

Q61: The accumulated earnings tax is designed to

Q68: Corporations may be subject to the alternative

Q76: The corporate alternative minimum tax rate is

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents