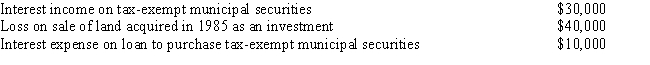

For the year ended December 31, 2014, Prunus, Inc., reported net income before federal income tax expense of $800,000 per the corporation's books. This figure included the following items: What is the taxable income of Prunus, Inc. for 2014?

A) $800,000

B) $820,000

C) $830,000

D) $870,000

E) None of the above

Correct Answer:

Verified

Q30: In general, estimated payments for calendar-year corporations

Q31: Which of the following items is not

Q44: Which of the following corporations is allowed

Q48: For the year ended June 30, 2014,

Q51: Harry forms the Nectarine Corporation during the

Q52: On July 1, 2014, Grey formed Arucaria

Q54: Roberta and Sally formed the Alder Corporation

Q55: Which of the following statements is not

Q64: What is the maximum amount of accumulated

Q68: Which of the following is not an

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents