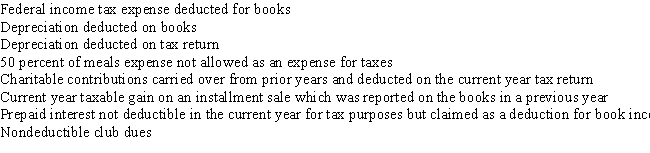

The Cat Corporation had $20,000 of book income in the current year. The following is a list of differences between federal and book income and expenses:

Based on the above information, calculate the Cat Corporation's federal taxable income for the year. Show your calculations.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q27: What is the purpose of Schedule M-1?

Q43: Fran, George, and Helen form FGH Corporation.

Q63: The Great Gumball Corporation is a gumball

Q66: During 2014, the Squamata Corporation, a regular

Q68: Rex and Marsha each own 50 percent

Q71: The Birch Corporation has regular taxable income

Q72: Avocado Corporation paid $3,000 in estimated tax

Q72: Ashwood Corporation has been in business for

Q73: The Lagerstroemia Corporation was formed on January

Q75: During the current year, The Jupiter Company,

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents