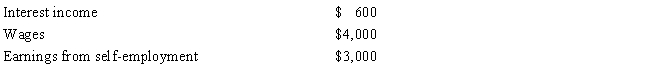

For the 2014 tax year, Sally, who is divorced, reported the following items of income: She maintains a household for herself and her 1-year-old son who qualifies as her dependent. What is the earned income credit available to her for 2014, using the tables?

A) $1,029

B) $1,369

C) $2,389

D) $2,593

E) None of the above

Correct Answer:

Verified

Q8: An individual may claim both a credit

Q20: The child tax credit is not available

Q21: Which of the following tax credits is

Q25: In 2014, Alex has income from wages

Q26: Keith has a 2014 tax liability of

Q28: Curly and Rita are married, file a

Q42: Hal is enrolled for one class at

Q93: Unearned income of a 16-year-old child may

Q127: New York is a community property state.

Q138: In all community property states, income from

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents