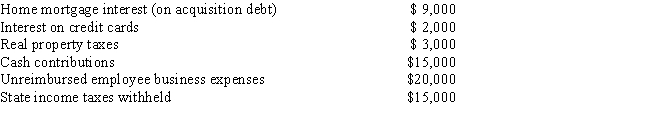

Dan and Maureen file a joint income tax return for 2014. They have two dependent children, ages 7 and 9. Together they earn wages of $152,000. They also receive taxable interest income of $8,000 and interest on City of Los Angeles bonds of $12,000. During 2014, they received a state income tax refund of $3,000 relating to their 2013 state income tax return on which they itemized deductions. Their expenses for the year consist of the following:

Calculate Dan and Maureen's tentative minimum tax liability assuming an exemption amount of $82,100, before any phase-outs. Show your calculations.

Correct Answer:

Verified

Q78: What is the purpose of the alternative

Q88: In 2014, Brady purchases a 2014 Nissan

Q89: Assume Alan's parents make gifts of $10,000

Q90: Rachel and Rob are married and living

Q91: Daddy Warbucks is in the process of

Q92: In 2014, Erin purchased a solar system

Q94: Other things equal, would a tax credit

Q95: Fletch and Cammie Gates are married with

Q97: Phillip and Naydeen Rivers are married with

Q98: Sheila and Jerry are married taxpayers with

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents