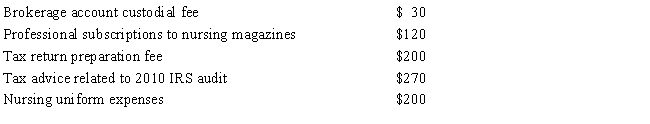

During the 2014 tax year, Ruth, a nurse at Dr. Pan's office, incurred the following expenses:

If Ruth's adjusted gross income is $28,000, calculate her net miscellaneous deductions after the adjusted gross income percentage limitation.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q81: Diane's engagement ring is stolen in the

Q82: Don gives his old car to a

Q96: Kat owns a small bungalow which is

Q103: Steve keeps a valuable bonsai collection in

Q104: In 2014, Geoffrey receives $20,000 from a

Q109: During 2014, Hom donates a sculpture that

Q110: Andy borrows $20,000 to invest in bonds.

Q114: Ronald donates publicly traded Microsystems stock with

Q127: Rob's employer has an accountable plan for

Q129: Lourdes is a paralegal.Since she often deals

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents