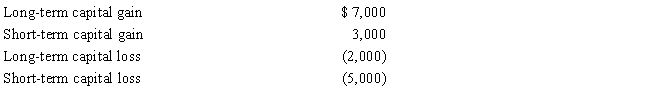

For the current year,Susan had salary income of $20,000.In addition she reported the following capital transactions during the year: There were no other items includable in her gross income.What is the amount of her adjusted gross income for the current year?

A) $19,000

B) $23,000

C) $24,000

D) $25,000

E) None of the above

Correct Answer:

Verified

Q22: For purposes of determining the adjusted basis

Q24: In December,2017,Ben and Jeri (married filing jointly)have

Q24: If a taxpayer is relieved of a

Q25: Which of the following is true about

Q25: The adjusted basis of an asset may

Q26: Sol purchased land as an investment on

Q29: Robert and Becca are in the 25

Q31: Sol purchased land as an investment on

Q36: If property is inherited by a taxpayer,

A)To

Q37: Net short-term capital gains may be offset

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents