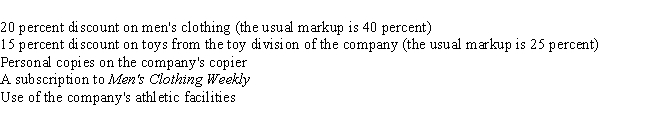

William,a single taxpayer,works for the men's clothing division of a large corporation.During the year,William received the following fringe benefits:

As a result of receiving the above fringe benefits,what amount must William include in his current year gross income?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q104: As a new benefit to employees, the

Q104: A taxpayer in the 28 percent tax

Q105: Mable is a wealthy widow who has

Q106: A taxpayer in the 33 percent tax

Q107: Interest earned on bonds issued by a

Q108: An investor is comparing the following two

Q109: Curt's tax client,Terry,is employed at a large

Q111: Indicate which of the following statements is

Q113: A "no-additional-cost" service includes only those services

Q114: Steve worked as a tech supervisor for

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents