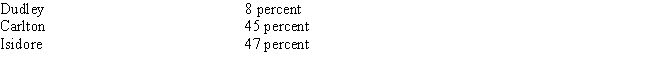

During the current tax year,Anita was entirely supported by her three sons,Dudley,Carlton,and Isidore,who provided support for her in the following percentages:  Which of the children may be allowed to claim his mother as a dependent,assuming a multiple support agreement exists?

Which of the children may be allowed to claim his mother as a dependent,assuming a multiple support agreement exists?

A) Dudley

B) Dudley or Carlton

C) Carlton or Isidore

D) Dudley,Carlton,or Isidore

E) None of the above

Correct Answer:

Verified

Q72: Match the letter of the filing status

Q82: Taxpayers who are blind get the benefit

Q86: An individual, age 22, enrolled on a

Q88: If a taxpayer's adjusted gross income exceeds

Q89: Albert and Louise,ages 66 and 64,respectively,filed a

Q89: Scholarships received by a student may be

Q91: For 2017,personal and dependency exemptions are $4,100

Q92: Mr.and Mrs.Vonce,both age 62,file a joint return

Q95: A dependency exemption may be claimed by

Q98: A child for whom a dependency exemption

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents