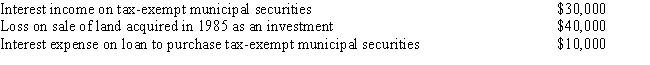

For the year ended December 31,2017,Prunus,Inc. ,reported net income before federal income tax expense of $800,000 per the corporation's books.This figure included the following items: What is the taxable income of Prunus,Inc.for 2017?

A) $800,000

B) $820,000

C) $830,000

D) $870,000

E) None of the above

Correct Answer:

Verified

Q25: The Lagerstroemia Corporation was formed on January

Q26: The Nandina Corporation was formed and began

Q26: During the current year, the Melaleuca Corporation

Q27: The F.Repens Corporation has taxable income of

Q27: What is the purpose of Schedule M-1?

Q30: In the current year,Parvifolia,Inc.had $400,000 of revenue

Q31: Which of the following items is not

Q31: The original due date for a tax

Q33: The Bay Fig Corporation has $350,000 of

Q36: To prevent triple taxation, a corporation is

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents