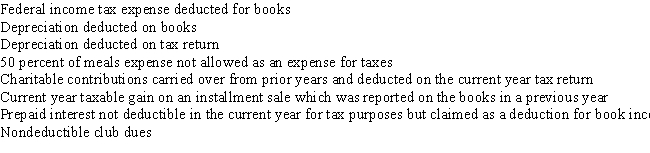

The Cat Corporation had $20,000 of book income in the current year.The following is a list of differences between federal and book income and expenses:

Based on the above information,calculate the Cat Corporation's federal taxable income for the year.Show your calculations.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q22: Schedule M-1 on Form 1120 shows the

Q23: A corporation must reconcile, to the IRS's

Q26: During the current year, the Melaleuca Corporation

Q27: What is the purpose of Schedule M-1?

Q28: Corporations can elect to deduct up to

Q30: In the current year,Parvifolia,Inc.had $400,000 of revenue

Q31: The original due date for a tax

Q33: The Bay Fig Corporation has $350,000 of

Q36: A regular corporation with excess charitable contributions

Q40: Ficus,Inc.began business on March 1,2017,and elected to

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents