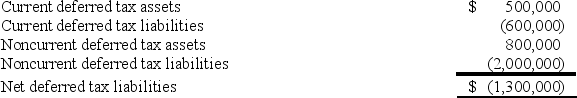

In 2018, Moody Corporation recorded the following deferred tax assets and liabilities:

All of the deferred tax accounts relate to temporary differences that result from the company's U.S. operations. Moody wants to minimize the number of deferred tax accounts it reports on the balance sheet. What is the minimum number of deferred tax accounts Moody reports on its balance sheet and what are the names and dollar amounts in each account?

All of the deferred tax accounts relate to temporary differences that result from the company's U.S. operations. Moody wants to minimize the number of deferred tax accounts it reports on the balance sheet. What is the minimum number of deferred tax accounts Moody reports on its balance sheet and what are the names and dollar amounts in each account?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q82: Whitman Corporation reported pretax book income of

Q85: Weber Corporation reported pretax book income of

Q86: Irish Corporation reported pretax book income of

Q88: Farm Corporation reported pretax book loss of

Q88: Morgan Corporation determined that $2,000,000 of the

Q92: Potter, Inc. reported pretax book income of

Q94: Stone Corporation reported pretax book income of

Q97: Oriole Company reported pretax net income from

Q99: Lafayette, Inc., completed its first year of

Q101: DeWitt Corporation reported pretax book income of

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents