Accounting for Decision Making and Control 7th Edition by Jerold Zimmerman

النسخة 7الرقم المعياري الدولي: 978-0078136726

Accounting for Decision Making and Control 7th Edition by Jerold Zimmerman

النسخة 7الرقم المعياري الدولي: 978-0078136726 تمرين 19

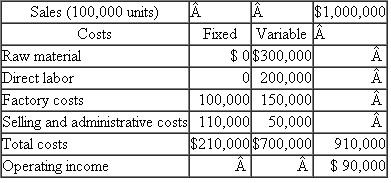

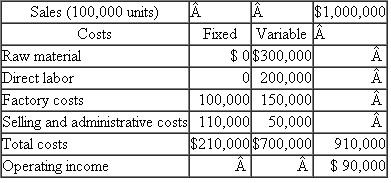

Bidwell Company

Data for the Bidwell Company are as follows: Required:

Required:

a. Based on the preceding data, calculate break-even sales in units.

b. If Bidwell Company is subject to an effective income tax rate of 40 percent, calculate the number of units Bidwell would have to sell to earn an after-tax profit of $90,000.

c. If fixed costs increase $31,500 with no other cost or revenue factors changing, calculate the break-even sales in units.

Source: CMA adapted.

Data for the Bidwell Company are as follows:

Required:

Required: a. Based on the preceding data, calculate break-even sales in units.

b. If Bidwell Company is subject to an effective income tax rate of 40 percent, calculate the number of units Bidwell would have to sell to earn an after-tax profit of $90,000.

c. If fixed costs increase $31,500 with no other cost or revenue factors changing, calculate the break-even sales in units.

Source: CMA adapted.

التوضيح

Break Even Sales

It is the amount of sa...

Accounting for Decision Making and Control 7th Edition by Jerold Zimmerman

لماذا لم يعجبك هذا التمرين؟

أخرى 8 أحرف كحد أدنى و 255 حرفاً كحد أقصى

حرف 255