Accounting for Decision Making and Control 7th Edition by Jerold Zimmerman

النسخة 7الرقم المعياري الدولي: 978-0078136726

Accounting for Decision Making and Control 7th Edition by Jerold Zimmerman

النسخة 7الرقم المعياري الدولي: 978-0078136726 تمرين 20

Jolsen International

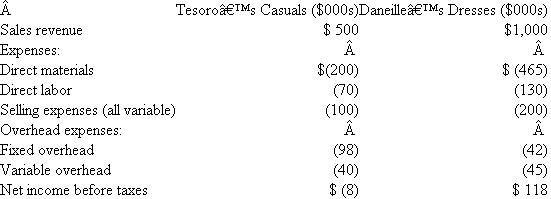

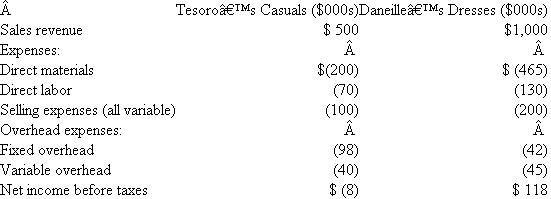

Jim Shoe, chief executive officer of Jolsen International, a multinational textile conglomerate, has recently been evaluating the profitability of one of the company's subsidiaries, Pride Fashions, Inc., located in Rochester, New York. The Rochester facility consists of a dress division and a casual wear division. Daneille's Dresses produces women's fine apparel, while the other division, Tesoro's Casuals, produces comfortable cotton casual clothing.

Jolsen's chief financial officer, Pete Moss, has recommended that the casual wear division be closed. The year-end financials Shoe just received show that Tesoro's Casuals has been operating at a loss for the past year, while Daneille's Dresses continues to show a respectable profit. Shoe is puzzled by this fact because he considers both managers to be very capable.

The Rochester site consists of a 140,000-square-foot building where Tesoro's Casuals and Daneille's Dresses utilize 70 percent and 30 percent of the floor space, respectively. Fixed overhead costs consist of the annual lease payment, fire insurance, security, and the common costs of the purchasing department's staff. Fixed overhead is allocated based on percentage of floor space. Housing both divisions in this facility seemed like an ideal situation to Shoe because both divisions purchase from many of the same suppliers and have the potential to combine materials ordering to take advantage of quality discounts. Furthermore, each division is serviced by the same maintenance department. However, the two managers have been plagued by an inability to cooperate due to disagreements over the selection of suppliers as well as the quantities to purchase from common suppliers. This is of serious concern to Shoe as he turns his attention to the report in front of him. Required:

Required:

a. Evaluate Pete Moss's recommendation to close Tesoro's Casuals.

b. Should the overhead costs be allocated based on floor space or some other measure? Justify your answer.

SOURCE: R Drake, J Olsen, and J Tesoro.

Jim Shoe, chief executive officer of Jolsen International, a multinational textile conglomerate, has recently been evaluating the profitability of one of the company's subsidiaries, Pride Fashions, Inc., located in Rochester, New York. The Rochester facility consists of a dress division and a casual wear division. Daneille's Dresses produces women's fine apparel, while the other division, Tesoro's Casuals, produces comfortable cotton casual clothing.

Jolsen's chief financial officer, Pete Moss, has recommended that the casual wear division be closed. The year-end financials Shoe just received show that Tesoro's Casuals has been operating at a loss for the past year, while Daneille's Dresses continues to show a respectable profit. Shoe is puzzled by this fact because he considers both managers to be very capable.

The Rochester site consists of a 140,000-square-foot building where Tesoro's Casuals and Daneille's Dresses utilize 70 percent and 30 percent of the floor space, respectively. Fixed overhead costs consist of the annual lease payment, fire insurance, security, and the common costs of the purchasing department's staff. Fixed overhead is allocated based on percentage of floor space. Housing both divisions in this facility seemed like an ideal situation to Shoe because both divisions purchase from many of the same suppliers and have the potential to combine materials ordering to take advantage of quality discounts. Furthermore, each division is serviced by the same maintenance department. However, the two managers have been plagued by an inability to cooperate due to disagreements over the selection of suppliers as well as the quantities to purchase from common suppliers. This is of serious concern to Shoe as he turns his attention to the report in front of him.

Required:

Required: a. Evaluate Pete Moss's recommendation to close Tesoro's Casuals.

b. Should the overhead costs be allocated based on floor space or some other measure? Justify your answer.

SOURCE: R Drake, J Olsen, and J Tesoro.

التوضيح

Operating Income

It is also known as Re...

Accounting for Decision Making and Control 7th Edition by Jerold Zimmerman

لماذا لم يعجبك هذا التمرين؟

أخرى 8 أحرف كحد أدنى و 255 حرفاً كحد أقصى

حرف 255