Accounting for Decision Making and Control 8th Edition by Jerold Zimmerman

النسخة 8الرقم المعياري الدولي: 978-0078025747

Accounting for Decision Making and Control 8th Edition by Jerold Zimmerman

النسخة 8الرقم المعياري الدولي: 978-0078025747 تمرين 14

Coase Farm

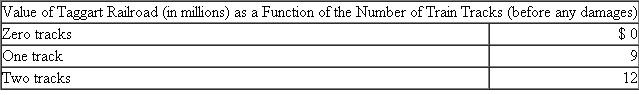

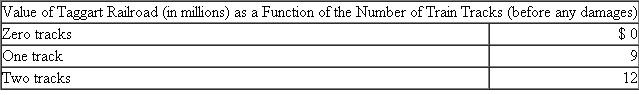

Coase Farm grows soybeans near property owned by Taggart Railroad. Taggart can build zero, one, or two railroad tracks adjacent to Coase Farm, yielding a net present value of $0, $9 million, or $12 million.

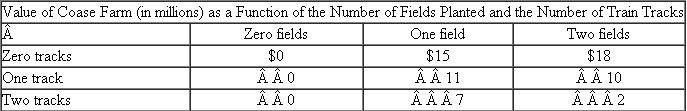

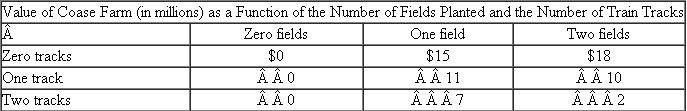

Coase Farm can grow soybeans on zero, one, or two fields, yielding a net present value of $0, $15 million, or $18 million before any environmental damages inflicted by Taggart trains. Environmental damages inflicted by Taggart's trains are $4 million per field per track. Coase Farm's payoffs as a function of the number of fields it uses to grow soybeans and the number of tracks that Taggart builds are shown below.

Coase Farm can grow soybeans on zero, one, or two fields, yielding a net present value of $0, $15 million, or $18 million before any environmental damages inflicted by Taggart trains. Environmental damages inflicted by Taggart's trains are $4 million per field per track. Coase Farm's payoffs as a function of the number of fields it uses to grow soybeans and the number of tracks that Taggart builds are shown below.

It is prohibitively expensive for Taggart Railroad and Coase Farm to enter into a long-term contract regarding either party's use of its land.

It is prohibitively expensive for Taggart Railroad and Coase Farm to enter into a long-term contract regarding either party's use of its land.

Required:

a. Suppose Taggart Railroad cannot be held liable for the damages its tracks inflict on Coase Farm. Showthat Taggart Railroad will build two tracks and Coase Farm will plant soybeans on one field.

b. Suppose Taggart Railroad can be held fully liable for the damages that its tracks inflict on Coase Farm. Show that Taggart Railroad will build one track and Coase Farm will plant soybeans on two fields.

c. Now suppose Taggart Railroad and Coase Farm merge. Show that the merged firm will build one track and plant soybeans on one field.

d. What are the implications of the merger for the organizational architecture of the newly merged firm in terms of decision rights, performance measurement, and employee compensation?

Source: R Sansing.

Coase Farm grows soybeans near property owned by Taggart Railroad. Taggart can build zero, one, or two railroad tracks adjacent to Coase Farm, yielding a net present value of $0, $9 million, or $12 million.

Coase Farm can grow soybeans on zero, one, or two fields, yielding a net present value of $0, $15 million, or $18 million before any environmental damages inflicted by Taggart trains. Environmental damages inflicted by Taggart's trains are $4 million per field per track. Coase Farm's payoffs as a function of the number of fields it uses to grow soybeans and the number of tracks that Taggart builds are shown below.

Coase Farm can grow soybeans on zero, one, or two fields, yielding a net present value of $0, $15 million, or $18 million before any environmental damages inflicted by Taggart trains. Environmental damages inflicted by Taggart's trains are $4 million per field per track. Coase Farm's payoffs as a function of the number of fields it uses to grow soybeans and the number of tracks that Taggart builds are shown below. It is prohibitively expensive for Taggart Railroad and Coase Farm to enter into a long-term contract regarding either party's use of its land.

It is prohibitively expensive for Taggart Railroad and Coase Farm to enter into a long-term contract regarding either party's use of its land.Required:

a. Suppose Taggart Railroad cannot be held liable for the damages its tracks inflict on Coase Farm. Showthat Taggart Railroad will build two tracks and Coase Farm will plant soybeans on one field.

b. Suppose Taggart Railroad can be held fully liable for the damages that its tracks inflict on Coase Farm. Show that Taggart Railroad will build one track and Coase Farm will plant soybeans on two fields.

c. Now suppose Taggart Railroad and Coase Farm merge. Show that the merged firm will build one track and plant soybeans on one field.

d. What are the implications of the merger for the organizational architecture of the newly merged firm in terms of decision rights, performance measurement, and employee compensation?

Source: R Sansing.

التوضيح

Organizational Architecture:

It can be ...

Accounting for Decision Making and Control 8th Edition by Jerold Zimmerman

لماذا لم يعجبك هذا التمرين؟

أخرى 8 أحرف كحد أدنى و 255 حرفاً كحد أقصى

حرف 255