Advanced Accounting 11th Edition by Paul Fischer,William Tayler, Rita Cheng

النسخة 11الرقم المعياري الدولي: 978-0538480284

Advanced Accounting 11th Edition by Paul Fischer,William Tayler, Rita Cheng

النسخة 11الرقم المعياري الدولي: 978-0538480284 تمرين 10

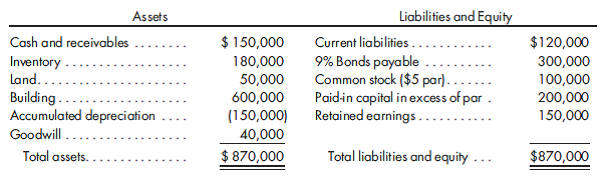

Estimate goodwill, record acquisition. Caswell Company is contemplating the purchase of LaBelle Company as of January 1, 2016. LaBelle Company has provided the following current balance sheet:

The following information exists relative to balance sheet accounts:

a. The inventory has a fair value of $200,000.

b. The land is appraised at $100,000 and the building at $600,000.

c. The 9% bonds payable have five years to maturity and pay annual interest each December 31. The current interest rate for similar bonds is 8% per year.

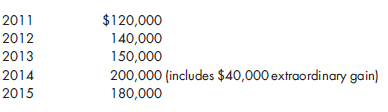

d. It is likely that there will be a payment for goodwill based on projected income in excess of the industry average, which is 10% on total assets. Caswell will project the average past five years' operating income and will pay for excess income based on an assumption of a 5-year life and a risk rate of return of 16%. The past five years' net incomes for LaBelle are as follows:

1. Provide an estimate of fair value for the bonds and for goodwill.

2. Using the values derived in part (1), record the acquisition on the Caswell books.

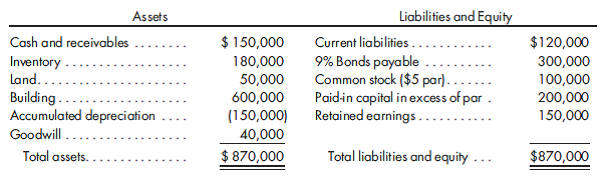

The following information exists relative to balance sheet accounts:

a. The inventory has a fair value of $200,000.

b. The land is appraised at $100,000 and the building at $600,000.

c. The 9% bonds payable have five years to maturity and pay annual interest each December 31. The current interest rate for similar bonds is 8% per year.

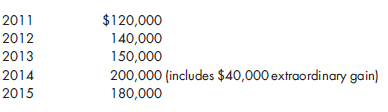

d. It is likely that there will be a payment for goodwill based on projected income in excess of the industry average, which is 10% on total assets. Caswell will project the average past five years' operating income and will pay for excess income based on an assumption of a 5-year life and a risk rate of return of 16%. The past five years' net incomes for LaBelle are as follows:

1. Provide an estimate of fair value for the bonds and for goodwill.

2. Using the values derived in part (1), record the acquisition on the Caswell books.

التوضيح

It is given that the cash receivable is ...

Advanced Accounting 11th Edition by Paul Fischer,William Tayler, Rita Cheng

لماذا لم يعجبك هذا التمرين؟

أخرى 8 أحرف كحد أدنى و 255 حرفاً كحد أقصى

حرف 255