Advanced Accounting 11th Edition by Paul Fischer,William Tayler, Rita Cheng

النسخة 11الرقم المعياري الدولي: 978-0538480284

Advanced Accounting 11th Edition by Paul Fischer,William Tayler, Rita Cheng

النسخة 11الرقم المعياري الدولي: 978-0538480284 تمرين 1

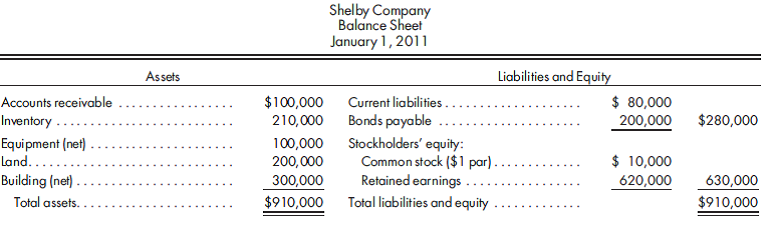

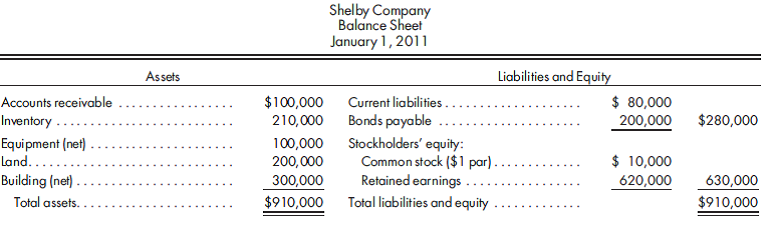

Acquisition with special valuations. Pederson Company acquires the net assets of Shelby Company by issuing 100,000 of its $1 par value shares of common stock. The shares have a fair value of $20 each. Just prior to the acquisition, Shelby's balance sheet is as follows:

Fair values agree with book values except for the building, which is appraised at $450,000.

The following additional information is available:

• The equipment will be sold for an estimated price of $200,000. A 10% commission will be paid to a broker.

• A major R D project is underway. The accumulated costs are $56,000, and the estimated value of the work is $90,000.

• A warranty attaches to products sold in the past. The estimated future repair costs under the warranty are $40,000.

• Shelby has a customer list that has value. It is estimated that the list will provide additional income of $100,000 for three years. An intangible asset such as this is valued at a 20% rate of return.

Record the acquisition of Shelby Company on the books of Pederson Company. Provide calculations where needed.

Fair values agree with book values except for the building, which is appraised at $450,000.

The following additional information is available:

• The equipment will be sold for an estimated price of $200,000. A 10% commission will be paid to a broker.

• A major R D project is underway. The accumulated costs are $56,000, and the estimated value of the work is $90,000.

• A warranty attaches to products sold in the past. The estimated future repair costs under the warranty are $40,000.

• Shelby has a customer list that has value. It is estimated that the list will provide additional income of $100,000 for three years. An intangible asset such as this is valued at a 20% rate of return.

Record the acquisition of Shelby Company on the books of Pederson Company. Provide calculations where needed.

التوضيح

Calculate common stock value.

It is calculated that the P company exchanges 100,000 shares and par value is $1.

Now, calculate common stock value:

![Calculate common stock value. It is calculated that the P company exchanges 100,000 shares and par value is $1. Now, calculate common stock value: ……(2)The calculated common stock value is . Calculate paid-in capital in excess of par. It is calculated that the total purchase consideration is $2,000,000 [refer to Equation (1)] and common stock value is $100,000 [refer to Equation (2)]. Now, calculate paid-in capital in excess of par: ……(3)The calculated paid- in capital in excess of Par is . Calculate value of net identifiable assets acquired. It is given that the accounts receivable is $100,000, inventory value is $210,000, equipment is , land value is $200,000, building value is $450,000, research and development project value is $90,000, customer list $210,650 (This amount is arrived using table and would be $210,648 using financial calculator or Excel), current liability value is $80,000, bonds payable is $200,000, and estimated liability under warranty is $40,000. Now, calculate value of net identifiable assets acquired: ……(4)The calculated value of net identifiable assets acquired is . Calculate excess of total cost over fair value of net assets or good will. It is calculated that the purchase consideration is $2,000,000 [refer to Equation (1)] and value of net identifiable assets acquired is $1,120,650 [refer to Equation (4)]. Now, calculate excess of total cost over fair value of net assets or good will: ……(5)The calculated excess of total cost over fair value of net assets or good will is a)Journal entry in the books of company P • All asset value increases the asset value in the balance sheet. Therefore, it is debited. • Liabilities and equities increase the liability value in the balance sheet. Therefore, they are credited. • The liability value is more than the asset value. Therefore, goodwill is debited.](https://d2lvgg3v3hfg70.cloudfront.net/SM1534/11eb5b63_55f4_ab42_bcf8_7b8bfb8f63c6_SM1534_00.jpg) ……(2)The calculated common stock value is

……(2)The calculated common stock value is

![Calculate common stock value. It is calculated that the P company exchanges 100,000 shares and par value is $1. Now, calculate common stock value: ……(2)The calculated common stock value is . Calculate paid-in capital in excess of par. It is calculated that the total purchase consideration is $2,000,000 [refer to Equation (1)] and common stock value is $100,000 [refer to Equation (2)]. Now, calculate paid-in capital in excess of par: ……(3)The calculated paid- in capital in excess of Par is . Calculate value of net identifiable assets acquired. It is given that the accounts receivable is $100,000, inventory value is $210,000, equipment is , land value is $200,000, building value is $450,000, research and development project value is $90,000, customer list $210,650 (This amount is arrived using table and would be $210,648 using financial calculator or Excel), current liability value is $80,000, bonds payable is $200,000, and estimated liability under warranty is $40,000. Now, calculate value of net identifiable assets acquired: ……(4)The calculated value of net identifiable assets acquired is . Calculate excess of total cost over fair value of net assets or good will. It is calculated that the purchase consideration is $2,000,000 [refer to Equation (1)] and value of net identifiable assets acquired is $1,120,650 [refer to Equation (4)]. Now, calculate excess of total cost over fair value of net assets or good will: ……(5)The calculated excess of total cost over fair value of net assets or good will is a)Journal entry in the books of company P • All asset value increases the asset value in the balance sheet. Therefore, it is debited. • Liabilities and equities increase the liability value in the balance sheet. Therefore, they are credited. • The liability value is more than the asset value. Therefore, goodwill is debited.](https://d2lvgg3v3hfg70.cloudfront.net/SM1534/11eb5b63_55f4_d253_bcf8_7b63d062b6f3_SM1534_11.jpg) .

.

Calculate paid-in capital in excess of par.

It is calculated that the total purchase consideration is $2,000,000 [refer to Equation (1)] and common stock value is $100,000 [refer to Equation (2)].

Now, calculate paid-in capital in excess of par:

![Calculate common stock value. It is calculated that the P company exchanges 100,000 shares and par value is $1. Now, calculate common stock value: ……(2)The calculated common stock value is . Calculate paid-in capital in excess of par. It is calculated that the total purchase consideration is $2,000,000 [refer to Equation (1)] and common stock value is $100,000 [refer to Equation (2)]. Now, calculate paid-in capital in excess of par: ……(3)The calculated paid- in capital in excess of Par is . Calculate value of net identifiable assets acquired. It is given that the accounts receivable is $100,000, inventory value is $210,000, equipment is , land value is $200,000, building value is $450,000, research and development project value is $90,000, customer list $210,650 (This amount is arrived using table and would be $210,648 using financial calculator or Excel), current liability value is $80,000, bonds payable is $200,000, and estimated liability under warranty is $40,000. Now, calculate value of net identifiable assets acquired: ……(4)The calculated value of net identifiable assets acquired is . Calculate excess of total cost over fair value of net assets or good will. It is calculated that the purchase consideration is $2,000,000 [refer to Equation (1)] and value of net identifiable assets acquired is $1,120,650 [refer to Equation (4)]. Now, calculate excess of total cost over fair value of net assets or good will: ……(5)The calculated excess of total cost over fair value of net assets or good will is a)Journal entry in the books of company P • All asset value increases the asset value in the balance sheet. Therefore, it is debited. • Liabilities and equities increase the liability value in the balance sheet. Therefore, they are credited. • The liability value is more than the asset value. Therefore, goodwill is debited.](https://d2lvgg3v3hfg70.cloudfront.net/SM1534/11eb5b63_55f4_f964_bcf8_c7f956ab9615_SM1534_00.jpg) ……(3)The calculated paid- in capital in excess of Par is

……(3)The calculated paid- in capital in excess of Par is

![Calculate common stock value. It is calculated that the P company exchanges 100,000 shares and par value is $1. Now, calculate common stock value: ……(2)The calculated common stock value is . Calculate paid-in capital in excess of par. It is calculated that the total purchase consideration is $2,000,000 [refer to Equation (1)] and common stock value is $100,000 [refer to Equation (2)]. Now, calculate paid-in capital in excess of par: ……(3)The calculated paid- in capital in excess of Par is . Calculate value of net identifiable assets acquired. It is given that the accounts receivable is $100,000, inventory value is $210,000, equipment is , land value is $200,000, building value is $450,000, research and development project value is $90,000, customer list $210,650 (This amount is arrived using table and would be $210,648 using financial calculator or Excel), current liability value is $80,000, bonds payable is $200,000, and estimated liability under warranty is $40,000. Now, calculate value of net identifiable assets acquired: ……(4)The calculated value of net identifiable assets acquired is . Calculate excess of total cost over fair value of net assets or good will. It is calculated that the purchase consideration is $2,000,000 [refer to Equation (1)] and value of net identifiable assets acquired is $1,120,650 [refer to Equation (4)]. Now, calculate excess of total cost over fair value of net assets or good will: ……(5)The calculated excess of total cost over fair value of net assets or good will is a)Journal entry in the books of company P • All asset value increases the asset value in the balance sheet. Therefore, it is debited. • Liabilities and equities increase the liability value in the balance sheet. Therefore, they are credited. • The liability value is more than the asset value. Therefore, goodwill is debited.](https://d2lvgg3v3hfg70.cloudfront.net/SM1534/11eb5b63_55f4_f965_bcf8_ad6b0109c8c9_SM1534_11.jpg) .

.

Calculate value of net identifiable assets acquired.

It is given that the accounts receivable is $100,000, inventory value is $210,000, equipment is

![Calculate common stock value. It is calculated that the P company exchanges 100,000 shares and par value is $1. Now, calculate common stock value: ……(2)The calculated common stock value is . Calculate paid-in capital in excess of par. It is calculated that the total purchase consideration is $2,000,000 [refer to Equation (1)] and common stock value is $100,000 [refer to Equation (2)]. Now, calculate paid-in capital in excess of par: ……(3)The calculated paid- in capital in excess of Par is . Calculate value of net identifiable assets acquired. It is given that the accounts receivable is $100,000, inventory value is $210,000, equipment is , land value is $200,000, building value is $450,000, research and development project value is $90,000, customer list $210,650 (This amount is arrived using table and would be $210,648 using financial calculator or Excel), current liability value is $80,000, bonds payable is $200,000, and estimated liability under warranty is $40,000. Now, calculate value of net identifiable assets acquired: ……(4)The calculated value of net identifiable assets acquired is . Calculate excess of total cost over fair value of net assets or good will. It is calculated that the purchase consideration is $2,000,000 [refer to Equation (1)] and value of net identifiable assets acquired is $1,120,650 [refer to Equation (4)]. Now, calculate excess of total cost over fair value of net assets or good will: ……(5)The calculated excess of total cost over fair value of net assets or good will is a)Journal entry in the books of company P • All asset value increases the asset value in the balance sheet. Therefore, it is debited. • Liabilities and equities increase the liability value in the balance sheet. Therefore, they are credited. • The liability value is more than the asset value. Therefore, goodwill is debited.](https://d2lvgg3v3hfg70.cloudfront.net/SM1534/11eb5b63_55f4_f966_bcf8_5b9e6a0d7021_SM1534_00.jpg) , land value is $200,000, building value is $450,000, research and development project value is $90,000, customer list $210,650 (This amount is arrived using table and would be $210,648 using financial calculator or Excel), current liability value is $80,000, bonds payable is $200,000, and estimated liability under warranty is $40,000.

, land value is $200,000, building value is $450,000, research and development project value is $90,000, customer list $210,650 (This amount is arrived using table and would be $210,648 using financial calculator or Excel), current liability value is $80,000, bonds payable is $200,000, and estimated liability under warranty is $40,000.

Now, calculate value of net identifiable assets acquired:

![Calculate common stock value. It is calculated that the P company exchanges 100,000 shares and par value is $1. Now, calculate common stock value: ……(2)The calculated common stock value is . Calculate paid-in capital in excess of par. It is calculated that the total purchase consideration is $2,000,000 [refer to Equation (1)] and common stock value is $100,000 [refer to Equation (2)]. Now, calculate paid-in capital in excess of par: ……(3)The calculated paid- in capital in excess of Par is . Calculate value of net identifiable assets acquired. It is given that the accounts receivable is $100,000, inventory value is $210,000, equipment is , land value is $200,000, building value is $450,000, research and development project value is $90,000, customer list $210,650 (This amount is arrived using table and would be $210,648 using financial calculator or Excel), current liability value is $80,000, bonds payable is $200,000, and estimated liability under warranty is $40,000. Now, calculate value of net identifiable assets acquired: ……(4)The calculated value of net identifiable assets acquired is . Calculate excess of total cost over fair value of net assets or good will. It is calculated that the purchase consideration is $2,000,000 [refer to Equation (1)] and value of net identifiable assets acquired is $1,120,650 [refer to Equation (4)]. Now, calculate excess of total cost over fair value of net assets or good will: ……(5)The calculated excess of total cost over fair value of net assets or good will is a)Journal entry in the books of company P • All asset value increases the asset value in the balance sheet. Therefore, it is debited. • Liabilities and equities increase the liability value in the balance sheet. Therefore, they are credited. • The liability value is more than the asset value. Therefore, goodwill is debited.](https://d2lvgg3v3hfg70.cloudfront.net/SM1534/11eb5b63_55f5_2077_bcf8_5743baa47287_SM1534_00.jpg) ……(4)The calculated value of net identifiable assets acquired is

……(4)The calculated value of net identifiable assets acquired is

![Calculate common stock value. It is calculated that the P company exchanges 100,000 shares and par value is $1. Now, calculate common stock value: ……(2)The calculated common stock value is . Calculate paid-in capital in excess of par. It is calculated that the total purchase consideration is $2,000,000 [refer to Equation (1)] and common stock value is $100,000 [refer to Equation (2)]. Now, calculate paid-in capital in excess of par: ……(3)The calculated paid- in capital in excess of Par is . Calculate value of net identifiable assets acquired. It is given that the accounts receivable is $100,000, inventory value is $210,000, equipment is , land value is $200,000, building value is $450,000, research and development project value is $90,000, customer list $210,650 (This amount is arrived using table and would be $210,648 using financial calculator or Excel), current liability value is $80,000, bonds payable is $200,000, and estimated liability under warranty is $40,000. Now, calculate value of net identifiable assets acquired: ……(4)The calculated value of net identifiable assets acquired is . Calculate excess of total cost over fair value of net assets or good will. It is calculated that the purchase consideration is $2,000,000 [refer to Equation (1)] and value of net identifiable assets acquired is $1,120,650 [refer to Equation (4)]. Now, calculate excess of total cost over fair value of net assets or good will: ……(5)The calculated excess of total cost over fair value of net assets or good will is a)Journal entry in the books of company P • All asset value increases the asset value in the balance sheet. Therefore, it is debited. • Liabilities and equities increase the liability value in the balance sheet. Therefore, they are credited. • The liability value is more than the asset value. Therefore, goodwill is debited.](https://d2lvgg3v3hfg70.cloudfront.net/SM1534/11eb5b63_55f5_2078_bcf8_d183dd06496f_SM1534_11.jpg) .

.

Calculate excess of total cost over fair value of net assets or good will.

It is calculated that the purchase consideration is $2,000,000 [refer to Equation (1)] and value of net identifiable assets acquired is $1,120,650 [refer to Equation (4)].

Now, calculate excess of total cost over fair value of net assets or good will:

![Calculate common stock value. It is calculated that the P company exchanges 100,000 shares and par value is $1. Now, calculate common stock value: ……(2)The calculated common stock value is . Calculate paid-in capital in excess of par. It is calculated that the total purchase consideration is $2,000,000 [refer to Equation (1)] and common stock value is $100,000 [refer to Equation (2)]. Now, calculate paid-in capital in excess of par: ……(3)The calculated paid- in capital in excess of Par is . Calculate value of net identifiable assets acquired. It is given that the accounts receivable is $100,000, inventory value is $210,000, equipment is , land value is $200,000, building value is $450,000, research and development project value is $90,000, customer list $210,650 (This amount is arrived using table and would be $210,648 using financial calculator or Excel), current liability value is $80,000, bonds payable is $200,000, and estimated liability under warranty is $40,000. Now, calculate value of net identifiable assets acquired: ……(4)The calculated value of net identifiable assets acquired is . Calculate excess of total cost over fair value of net assets or good will. It is calculated that the purchase consideration is $2,000,000 [refer to Equation (1)] and value of net identifiable assets acquired is $1,120,650 [refer to Equation (4)]. Now, calculate excess of total cost over fair value of net assets or good will: ……(5)The calculated excess of total cost over fair value of net assets or good will is a)Journal entry in the books of company P • All asset value increases the asset value in the balance sheet. Therefore, it is debited. • Liabilities and equities increase the liability value in the balance sheet. Therefore, they are credited. • The liability value is more than the asset value. Therefore, goodwill is debited.](https://d2lvgg3v3hfg70.cloudfront.net/SM1534/11eb5b63_55f5_2079_bcf8_a3b79fb1ee96_SM1534_00.jpg) ……(5)The calculated excess of total cost over fair value of net assets or good will is

……(5)The calculated excess of total cost over fair value of net assets or good will is

![Calculate common stock value. It is calculated that the P company exchanges 100,000 shares and par value is $1. Now, calculate common stock value: ……(2)The calculated common stock value is . Calculate paid-in capital in excess of par. It is calculated that the total purchase consideration is $2,000,000 [refer to Equation (1)] and common stock value is $100,000 [refer to Equation (2)]. Now, calculate paid-in capital in excess of par: ……(3)The calculated paid- in capital in excess of Par is . Calculate value of net identifiable assets acquired. It is given that the accounts receivable is $100,000, inventory value is $210,000, equipment is , land value is $200,000, building value is $450,000, research and development project value is $90,000, customer list $210,650 (This amount is arrived using table and would be $210,648 using financial calculator or Excel), current liability value is $80,000, bonds payable is $200,000, and estimated liability under warranty is $40,000. Now, calculate value of net identifiable assets acquired: ……(4)The calculated value of net identifiable assets acquired is . Calculate excess of total cost over fair value of net assets or good will. It is calculated that the purchase consideration is $2,000,000 [refer to Equation (1)] and value of net identifiable assets acquired is $1,120,650 [refer to Equation (4)]. Now, calculate excess of total cost over fair value of net assets or good will: ……(5)The calculated excess of total cost over fair value of net assets or good will is a)Journal entry in the books of company P • All asset value increases the asset value in the balance sheet. Therefore, it is debited. • Liabilities and equities increase the liability value in the balance sheet. Therefore, they are credited. • The liability value is more than the asset value. Therefore, goodwill is debited.](https://d2lvgg3v3hfg70.cloudfront.net/SM1534/11eb5b63_55f5_207a_bcf8_6b1582cd8df9_SM1534_11.jpg) a)Journal entry in the books of company P

a)Journal entry in the books of company P

![Calculate common stock value. It is calculated that the P company exchanges 100,000 shares and par value is $1. Now, calculate common stock value: ……(2)The calculated common stock value is . Calculate paid-in capital in excess of par. It is calculated that the total purchase consideration is $2,000,000 [refer to Equation (1)] and common stock value is $100,000 [refer to Equation (2)]. Now, calculate paid-in capital in excess of par: ……(3)The calculated paid- in capital in excess of Par is . Calculate value of net identifiable assets acquired. It is given that the accounts receivable is $100,000, inventory value is $210,000, equipment is , land value is $200,000, building value is $450,000, research and development project value is $90,000, customer list $210,650 (This amount is arrived using table and would be $210,648 using financial calculator or Excel), current liability value is $80,000, bonds payable is $200,000, and estimated liability under warranty is $40,000. Now, calculate value of net identifiable assets acquired: ……(4)The calculated value of net identifiable assets acquired is . Calculate excess of total cost over fair value of net assets or good will. It is calculated that the purchase consideration is $2,000,000 [refer to Equation (1)] and value of net identifiable assets acquired is $1,120,650 [refer to Equation (4)]. Now, calculate excess of total cost over fair value of net assets or good will: ……(5)The calculated excess of total cost over fair value of net assets or good will is a)Journal entry in the books of company P • All asset value increases the asset value in the balance sheet. Therefore, it is debited. • Liabilities and equities increase the liability value in the balance sheet. Therefore, they are credited. • The liability value is more than the asset value. Therefore, goodwill is debited.](https://d2lvgg3v3hfg70.cloudfront.net/SM1534/11eb5b63_55f5_478b_bcf8_49ef6675cfce_SM1534_00.jpg) • All asset value increases the asset value in the balance sheet. Therefore, it is debited.

• All asset value increases the asset value in the balance sheet. Therefore, it is debited.

• Liabilities and equities increase the liability value in the balance sheet. Therefore, they are credited.

• The liability value is more than the asset value. Therefore, goodwill is debited.

It is calculated that the P company exchanges 100,000 shares and par value is $1.

Now, calculate common stock value:

![Calculate common stock value. It is calculated that the P company exchanges 100,000 shares and par value is $1. Now, calculate common stock value: ……(2)The calculated common stock value is . Calculate paid-in capital in excess of par. It is calculated that the total purchase consideration is $2,000,000 [refer to Equation (1)] and common stock value is $100,000 [refer to Equation (2)]. Now, calculate paid-in capital in excess of par: ……(3)The calculated paid- in capital in excess of Par is . Calculate value of net identifiable assets acquired. It is given that the accounts receivable is $100,000, inventory value is $210,000, equipment is , land value is $200,000, building value is $450,000, research and development project value is $90,000, customer list $210,650 (This amount is arrived using table and would be $210,648 using financial calculator or Excel), current liability value is $80,000, bonds payable is $200,000, and estimated liability under warranty is $40,000. Now, calculate value of net identifiable assets acquired: ……(4)The calculated value of net identifiable assets acquired is . Calculate excess of total cost over fair value of net assets or good will. It is calculated that the purchase consideration is $2,000,000 [refer to Equation (1)] and value of net identifiable assets acquired is $1,120,650 [refer to Equation (4)]. Now, calculate excess of total cost over fair value of net assets or good will: ……(5)The calculated excess of total cost over fair value of net assets or good will is a)Journal entry in the books of company P • All asset value increases the asset value in the balance sheet. Therefore, it is debited. • Liabilities and equities increase the liability value in the balance sheet. Therefore, they are credited. • The liability value is more than the asset value. Therefore, goodwill is debited.](https://d2lvgg3v3hfg70.cloudfront.net/SM1534/11eb5b63_55f4_ab42_bcf8_7b8bfb8f63c6_SM1534_00.jpg) ……(2)The calculated common stock value is

……(2)The calculated common stock value is ![Calculate common stock value. It is calculated that the P company exchanges 100,000 shares and par value is $1. Now, calculate common stock value: ……(2)The calculated common stock value is . Calculate paid-in capital in excess of par. It is calculated that the total purchase consideration is $2,000,000 [refer to Equation (1)] and common stock value is $100,000 [refer to Equation (2)]. Now, calculate paid-in capital in excess of par: ……(3)The calculated paid- in capital in excess of Par is . Calculate value of net identifiable assets acquired. It is given that the accounts receivable is $100,000, inventory value is $210,000, equipment is , land value is $200,000, building value is $450,000, research and development project value is $90,000, customer list $210,650 (This amount is arrived using table and would be $210,648 using financial calculator or Excel), current liability value is $80,000, bonds payable is $200,000, and estimated liability under warranty is $40,000. Now, calculate value of net identifiable assets acquired: ……(4)The calculated value of net identifiable assets acquired is . Calculate excess of total cost over fair value of net assets or good will. It is calculated that the purchase consideration is $2,000,000 [refer to Equation (1)] and value of net identifiable assets acquired is $1,120,650 [refer to Equation (4)]. Now, calculate excess of total cost over fair value of net assets or good will: ……(5)The calculated excess of total cost over fair value of net assets or good will is a)Journal entry in the books of company P • All asset value increases the asset value in the balance sheet. Therefore, it is debited. • Liabilities and equities increase the liability value in the balance sheet. Therefore, they are credited. • The liability value is more than the asset value. Therefore, goodwill is debited.](https://d2lvgg3v3hfg70.cloudfront.net/SM1534/11eb5b63_55f4_d253_bcf8_7b63d062b6f3_SM1534_11.jpg) .

.Calculate paid-in capital in excess of par.

It is calculated that the total purchase consideration is $2,000,000 [refer to Equation (1)] and common stock value is $100,000 [refer to Equation (2)].

Now, calculate paid-in capital in excess of par:

![Calculate common stock value. It is calculated that the P company exchanges 100,000 shares and par value is $1. Now, calculate common stock value: ……(2)The calculated common stock value is . Calculate paid-in capital in excess of par. It is calculated that the total purchase consideration is $2,000,000 [refer to Equation (1)] and common stock value is $100,000 [refer to Equation (2)]. Now, calculate paid-in capital in excess of par: ……(3)The calculated paid- in capital in excess of Par is . Calculate value of net identifiable assets acquired. It is given that the accounts receivable is $100,000, inventory value is $210,000, equipment is , land value is $200,000, building value is $450,000, research and development project value is $90,000, customer list $210,650 (This amount is arrived using table and would be $210,648 using financial calculator or Excel), current liability value is $80,000, bonds payable is $200,000, and estimated liability under warranty is $40,000. Now, calculate value of net identifiable assets acquired: ……(4)The calculated value of net identifiable assets acquired is . Calculate excess of total cost over fair value of net assets or good will. It is calculated that the purchase consideration is $2,000,000 [refer to Equation (1)] and value of net identifiable assets acquired is $1,120,650 [refer to Equation (4)]. Now, calculate excess of total cost over fair value of net assets or good will: ……(5)The calculated excess of total cost over fair value of net assets or good will is a)Journal entry in the books of company P • All asset value increases the asset value in the balance sheet. Therefore, it is debited. • Liabilities and equities increase the liability value in the balance sheet. Therefore, they are credited. • The liability value is more than the asset value. Therefore, goodwill is debited.](https://d2lvgg3v3hfg70.cloudfront.net/SM1534/11eb5b63_55f4_f964_bcf8_c7f956ab9615_SM1534_00.jpg) ……(3)The calculated paid- in capital in excess of Par is

……(3)The calculated paid- in capital in excess of Par is ![Calculate common stock value. It is calculated that the P company exchanges 100,000 shares and par value is $1. Now, calculate common stock value: ……(2)The calculated common stock value is . Calculate paid-in capital in excess of par. It is calculated that the total purchase consideration is $2,000,000 [refer to Equation (1)] and common stock value is $100,000 [refer to Equation (2)]. Now, calculate paid-in capital in excess of par: ……(3)The calculated paid- in capital in excess of Par is . Calculate value of net identifiable assets acquired. It is given that the accounts receivable is $100,000, inventory value is $210,000, equipment is , land value is $200,000, building value is $450,000, research and development project value is $90,000, customer list $210,650 (This amount is arrived using table and would be $210,648 using financial calculator or Excel), current liability value is $80,000, bonds payable is $200,000, and estimated liability under warranty is $40,000. Now, calculate value of net identifiable assets acquired: ……(4)The calculated value of net identifiable assets acquired is . Calculate excess of total cost over fair value of net assets or good will. It is calculated that the purchase consideration is $2,000,000 [refer to Equation (1)] and value of net identifiable assets acquired is $1,120,650 [refer to Equation (4)]. Now, calculate excess of total cost over fair value of net assets or good will: ……(5)The calculated excess of total cost over fair value of net assets or good will is a)Journal entry in the books of company P • All asset value increases the asset value in the balance sheet. Therefore, it is debited. • Liabilities and equities increase the liability value in the balance sheet. Therefore, they are credited. • The liability value is more than the asset value. Therefore, goodwill is debited.](https://d2lvgg3v3hfg70.cloudfront.net/SM1534/11eb5b63_55f4_f965_bcf8_ad6b0109c8c9_SM1534_11.jpg) .

.Calculate value of net identifiable assets acquired.

It is given that the accounts receivable is $100,000, inventory value is $210,000, equipment is

![Calculate common stock value. It is calculated that the P company exchanges 100,000 shares and par value is $1. Now, calculate common stock value: ……(2)The calculated common stock value is . Calculate paid-in capital in excess of par. It is calculated that the total purchase consideration is $2,000,000 [refer to Equation (1)] and common stock value is $100,000 [refer to Equation (2)]. Now, calculate paid-in capital in excess of par: ……(3)The calculated paid- in capital in excess of Par is . Calculate value of net identifiable assets acquired. It is given that the accounts receivable is $100,000, inventory value is $210,000, equipment is , land value is $200,000, building value is $450,000, research and development project value is $90,000, customer list $210,650 (This amount is arrived using table and would be $210,648 using financial calculator or Excel), current liability value is $80,000, bonds payable is $200,000, and estimated liability under warranty is $40,000. Now, calculate value of net identifiable assets acquired: ……(4)The calculated value of net identifiable assets acquired is . Calculate excess of total cost over fair value of net assets or good will. It is calculated that the purchase consideration is $2,000,000 [refer to Equation (1)] and value of net identifiable assets acquired is $1,120,650 [refer to Equation (4)]. Now, calculate excess of total cost over fair value of net assets or good will: ……(5)The calculated excess of total cost over fair value of net assets or good will is a)Journal entry in the books of company P • All asset value increases the asset value in the balance sheet. Therefore, it is debited. • Liabilities and equities increase the liability value in the balance sheet. Therefore, they are credited. • The liability value is more than the asset value. Therefore, goodwill is debited.](https://d2lvgg3v3hfg70.cloudfront.net/SM1534/11eb5b63_55f4_f966_bcf8_5b9e6a0d7021_SM1534_00.jpg) , land value is $200,000, building value is $450,000, research and development project value is $90,000, customer list $210,650 (This amount is arrived using table and would be $210,648 using financial calculator or Excel), current liability value is $80,000, bonds payable is $200,000, and estimated liability under warranty is $40,000.

, land value is $200,000, building value is $450,000, research and development project value is $90,000, customer list $210,650 (This amount is arrived using table and would be $210,648 using financial calculator or Excel), current liability value is $80,000, bonds payable is $200,000, and estimated liability under warranty is $40,000.Now, calculate value of net identifiable assets acquired:

![Calculate common stock value. It is calculated that the P company exchanges 100,000 shares and par value is $1. Now, calculate common stock value: ……(2)The calculated common stock value is . Calculate paid-in capital in excess of par. It is calculated that the total purchase consideration is $2,000,000 [refer to Equation (1)] and common stock value is $100,000 [refer to Equation (2)]. Now, calculate paid-in capital in excess of par: ……(3)The calculated paid- in capital in excess of Par is . Calculate value of net identifiable assets acquired. It is given that the accounts receivable is $100,000, inventory value is $210,000, equipment is , land value is $200,000, building value is $450,000, research and development project value is $90,000, customer list $210,650 (This amount is arrived using table and would be $210,648 using financial calculator or Excel), current liability value is $80,000, bonds payable is $200,000, and estimated liability under warranty is $40,000. Now, calculate value of net identifiable assets acquired: ……(4)The calculated value of net identifiable assets acquired is . Calculate excess of total cost over fair value of net assets or good will. It is calculated that the purchase consideration is $2,000,000 [refer to Equation (1)] and value of net identifiable assets acquired is $1,120,650 [refer to Equation (4)]. Now, calculate excess of total cost over fair value of net assets or good will: ……(5)The calculated excess of total cost over fair value of net assets or good will is a)Journal entry in the books of company P • All asset value increases the asset value in the balance sheet. Therefore, it is debited. • Liabilities and equities increase the liability value in the balance sheet. Therefore, they are credited. • The liability value is more than the asset value. Therefore, goodwill is debited.](https://d2lvgg3v3hfg70.cloudfront.net/SM1534/11eb5b63_55f5_2077_bcf8_5743baa47287_SM1534_00.jpg) ……(4)The calculated value of net identifiable assets acquired is

……(4)The calculated value of net identifiable assets acquired is ![Calculate common stock value. It is calculated that the P company exchanges 100,000 shares and par value is $1. Now, calculate common stock value: ……(2)The calculated common stock value is . Calculate paid-in capital in excess of par. It is calculated that the total purchase consideration is $2,000,000 [refer to Equation (1)] and common stock value is $100,000 [refer to Equation (2)]. Now, calculate paid-in capital in excess of par: ……(3)The calculated paid- in capital in excess of Par is . Calculate value of net identifiable assets acquired. It is given that the accounts receivable is $100,000, inventory value is $210,000, equipment is , land value is $200,000, building value is $450,000, research and development project value is $90,000, customer list $210,650 (This amount is arrived using table and would be $210,648 using financial calculator or Excel), current liability value is $80,000, bonds payable is $200,000, and estimated liability under warranty is $40,000. Now, calculate value of net identifiable assets acquired: ……(4)The calculated value of net identifiable assets acquired is . Calculate excess of total cost over fair value of net assets or good will. It is calculated that the purchase consideration is $2,000,000 [refer to Equation (1)] and value of net identifiable assets acquired is $1,120,650 [refer to Equation (4)]. Now, calculate excess of total cost over fair value of net assets or good will: ……(5)The calculated excess of total cost over fair value of net assets or good will is a)Journal entry in the books of company P • All asset value increases the asset value in the balance sheet. Therefore, it is debited. • Liabilities and equities increase the liability value in the balance sheet. Therefore, they are credited. • The liability value is more than the asset value. Therefore, goodwill is debited.](https://d2lvgg3v3hfg70.cloudfront.net/SM1534/11eb5b63_55f5_2078_bcf8_d183dd06496f_SM1534_11.jpg) .

.Calculate excess of total cost over fair value of net assets or good will.

It is calculated that the purchase consideration is $2,000,000 [refer to Equation (1)] and value of net identifiable assets acquired is $1,120,650 [refer to Equation (4)].

Now, calculate excess of total cost over fair value of net assets or good will:

![Calculate common stock value. It is calculated that the P company exchanges 100,000 shares and par value is $1. Now, calculate common stock value: ……(2)The calculated common stock value is . Calculate paid-in capital in excess of par. It is calculated that the total purchase consideration is $2,000,000 [refer to Equation (1)] and common stock value is $100,000 [refer to Equation (2)]. Now, calculate paid-in capital in excess of par: ……(3)The calculated paid- in capital in excess of Par is . Calculate value of net identifiable assets acquired. It is given that the accounts receivable is $100,000, inventory value is $210,000, equipment is , land value is $200,000, building value is $450,000, research and development project value is $90,000, customer list $210,650 (This amount is arrived using table and would be $210,648 using financial calculator or Excel), current liability value is $80,000, bonds payable is $200,000, and estimated liability under warranty is $40,000. Now, calculate value of net identifiable assets acquired: ……(4)The calculated value of net identifiable assets acquired is . Calculate excess of total cost over fair value of net assets or good will. It is calculated that the purchase consideration is $2,000,000 [refer to Equation (1)] and value of net identifiable assets acquired is $1,120,650 [refer to Equation (4)]. Now, calculate excess of total cost over fair value of net assets or good will: ……(5)The calculated excess of total cost over fair value of net assets or good will is a)Journal entry in the books of company P • All asset value increases the asset value in the balance sheet. Therefore, it is debited. • Liabilities and equities increase the liability value in the balance sheet. Therefore, they are credited. • The liability value is more than the asset value. Therefore, goodwill is debited.](https://d2lvgg3v3hfg70.cloudfront.net/SM1534/11eb5b63_55f5_2079_bcf8_a3b79fb1ee96_SM1534_00.jpg) ……(5)The calculated excess of total cost over fair value of net assets or good will is

……(5)The calculated excess of total cost over fair value of net assets or good will is ![Calculate common stock value. It is calculated that the P company exchanges 100,000 shares and par value is $1. Now, calculate common stock value: ……(2)The calculated common stock value is . Calculate paid-in capital in excess of par. It is calculated that the total purchase consideration is $2,000,000 [refer to Equation (1)] and common stock value is $100,000 [refer to Equation (2)]. Now, calculate paid-in capital in excess of par: ……(3)The calculated paid- in capital in excess of Par is . Calculate value of net identifiable assets acquired. It is given that the accounts receivable is $100,000, inventory value is $210,000, equipment is , land value is $200,000, building value is $450,000, research and development project value is $90,000, customer list $210,650 (This amount is arrived using table and would be $210,648 using financial calculator or Excel), current liability value is $80,000, bonds payable is $200,000, and estimated liability under warranty is $40,000. Now, calculate value of net identifiable assets acquired: ……(4)The calculated value of net identifiable assets acquired is . Calculate excess of total cost over fair value of net assets or good will. It is calculated that the purchase consideration is $2,000,000 [refer to Equation (1)] and value of net identifiable assets acquired is $1,120,650 [refer to Equation (4)]. Now, calculate excess of total cost over fair value of net assets or good will: ……(5)The calculated excess of total cost over fair value of net assets or good will is a)Journal entry in the books of company P • All asset value increases the asset value in the balance sheet. Therefore, it is debited. • Liabilities and equities increase the liability value in the balance sheet. Therefore, they are credited. • The liability value is more than the asset value. Therefore, goodwill is debited.](https://d2lvgg3v3hfg70.cloudfront.net/SM1534/11eb5b63_55f5_207a_bcf8_6b1582cd8df9_SM1534_11.jpg) a)Journal entry in the books of company P

a)Journal entry in the books of company P ![Calculate common stock value. It is calculated that the P company exchanges 100,000 shares and par value is $1. Now, calculate common stock value: ……(2)The calculated common stock value is . Calculate paid-in capital in excess of par. It is calculated that the total purchase consideration is $2,000,000 [refer to Equation (1)] and common stock value is $100,000 [refer to Equation (2)]. Now, calculate paid-in capital in excess of par: ……(3)The calculated paid- in capital in excess of Par is . Calculate value of net identifiable assets acquired. It is given that the accounts receivable is $100,000, inventory value is $210,000, equipment is , land value is $200,000, building value is $450,000, research and development project value is $90,000, customer list $210,650 (This amount is arrived using table and would be $210,648 using financial calculator or Excel), current liability value is $80,000, bonds payable is $200,000, and estimated liability under warranty is $40,000. Now, calculate value of net identifiable assets acquired: ……(4)The calculated value of net identifiable assets acquired is . Calculate excess of total cost over fair value of net assets or good will. It is calculated that the purchase consideration is $2,000,000 [refer to Equation (1)] and value of net identifiable assets acquired is $1,120,650 [refer to Equation (4)]. Now, calculate excess of total cost over fair value of net assets or good will: ……(5)The calculated excess of total cost over fair value of net assets or good will is a)Journal entry in the books of company P • All asset value increases the asset value in the balance sheet. Therefore, it is debited. • Liabilities and equities increase the liability value in the balance sheet. Therefore, they are credited. • The liability value is more than the asset value. Therefore, goodwill is debited.](https://d2lvgg3v3hfg70.cloudfront.net/SM1534/11eb5b63_55f5_478b_bcf8_49ef6675cfce_SM1534_00.jpg) • All asset value increases the asset value in the balance sheet. Therefore, it is debited.

• All asset value increases the asset value in the balance sheet. Therefore, it is debited.• Liabilities and equities increase the liability value in the balance sheet. Therefore, they are credited.

• The liability value is more than the asset value. Therefore, goodwill is debited.

Advanced Accounting 11th Edition by Paul Fischer,William Tayler, Rita Cheng

لماذا لم يعجبك هذا التمرين؟

أخرى 8 أحرف كحد أدنى و 255 حرفاً كحد أقصى

حرف 255