Advanced Accounting 11th Edition by Paul Fischer,William Tayler, Rita Cheng

النسخة 11الرقم المعياري الدولي: 978-0538480284

Advanced Accounting 11th Edition by Paul Fischer,William Tayler, Rita Cheng

النسخة 11الرقم المعياري الدولي: 978-0538480284 تمرين 33

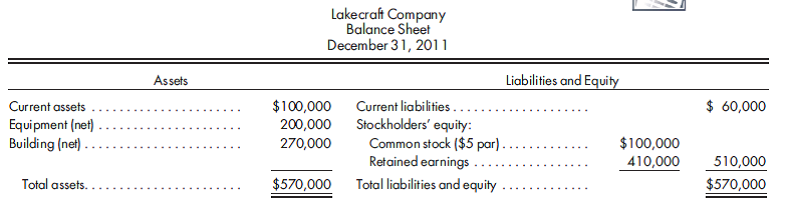

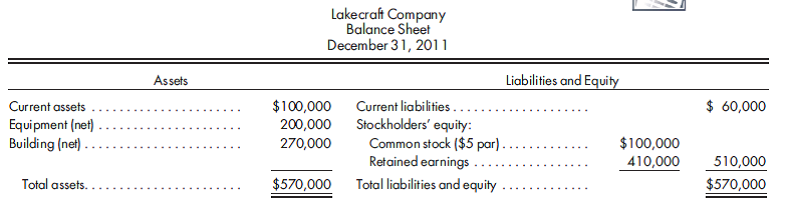

Tax loss carryover. Lakecraft Company has the following balance sheet on December 31, 2011, when it is acquired for $950,000 in cash by Argo Corporation:

All assets have fair values equal to their book values. The combination is structured as a taxfree exchange. Lakecraft Company has a tax loss carryforward of $300,000, which it has not recorded. The balance of the $300,000 tax loss carryover is considered fully realizable. Argo is taxed at a rate of 30%.

Record the acquisition of Lakecraft Company by Argo Corporation.

All assets have fair values equal to their book values. The combination is structured as a taxfree exchange. Lakecraft Company has a tax loss carryforward of $300,000, which it has not recorded. The balance of the $300,000 tax loss carryover is considered fully realizable. Argo is taxed at a rate of 30%.

Record the acquisition of Lakecraft Company by Argo Corporation.

التوضيح

Calculate fair value of net asset.

It is...

Advanced Accounting 11th Edition by Paul Fischer,William Tayler, Rita Cheng

لماذا لم يعجبك هذا التمرين؟

أخرى 8 أحرف كحد أدنى و 255 حرفاً كحد أقصى

حرف 255