Advanced Accounting 11th Edition by Paul Fischer,William Tayler, Rita Cheng

النسخة 11الرقم المعياري الدولي: 978-0538480284

Advanced Accounting 11th Edition by Paul Fischer,William Tayler, Rita Cheng

النسخة 11الرقم المعياري الدولي: 978-0538480284 تمرين 35

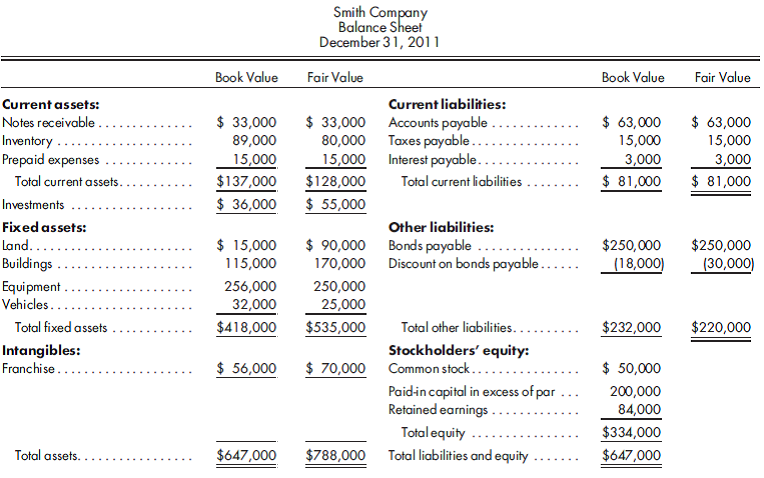

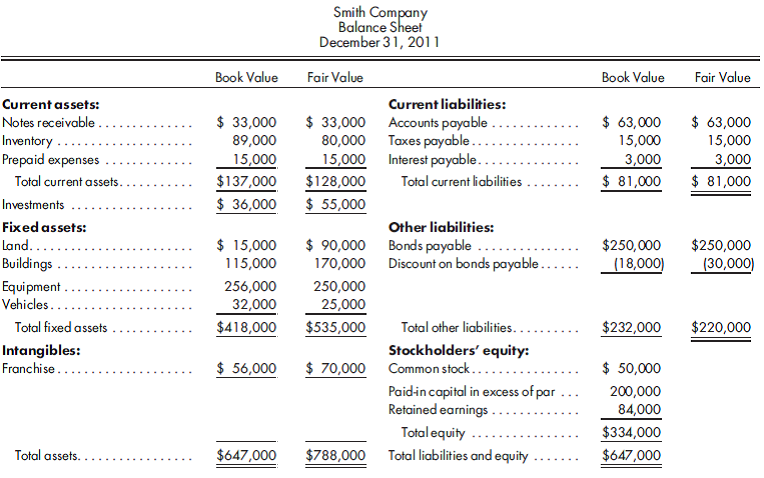

Acquisition with contingent consideration. Hite Corporation is contemplating the acquisition of Smith Company's net assets on December 31, 2011. It is considering making an offer, which would include a cash payout of $200,000 along with giving 15,000 shares of its $2 par value common stock that is currently selling for $20 per share. Hite also agrees that it will pay an additional $50,000 on January 1, 2014, if the average net income of Smith's business unit exceeds $80,000 for 2012 and 2013. The likelihood of reaching that target is estimated to be 75%. The balance sheet of Smith Company is given below, along with estimated fair values of the net assets to be acquired.

1. Do value analysis and prepare the entry on the books of Hite Corporation to record the acquisition of Smith Company.

2. Assume that the net income of the Smith business unit is $120,000 for 2012. As a result, the likelihood of paying the contingent consideration is believed to be 90%. What, if any, adjusting entry is required as of December 31, 2012?

1. Do value analysis and prepare the entry on the books of Hite Corporation to record the acquisition of Smith Company.

2. Assume that the net income of the Smith business unit is $120,000 for 2012. As a result, the likelihood of paying the contingent consideration is believed to be 90%. What, if any, adjusting entry is required as of December 31, 2012?

التوضيح

Calculate purchase consideration.

It is ...

Advanced Accounting 11th Edition by Paul Fischer,William Tayler, Rita Cheng

لماذا لم يعجبك هذا التمرين؟

أخرى 8 أحرف كحد أدنى و 255 حرفاً كحد أقصى

حرف 255