Advanced Accounting 11th Edition by Paul Fischer,William Tayler, Rita Cheng

النسخة 11الرقم المعياري الدولي: 978-0538480284

Advanced Accounting 11th Edition by Paul Fischer,William Tayler, Rita Cheng

النسخة 11الرقم المعياري الدولي: 978-0538480284 تمرين 24

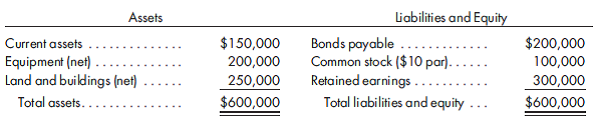

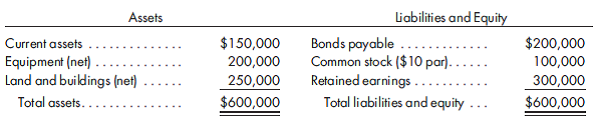

Tax-free exchange, tax loss carryover. Hanson Company issues 10,000 shares of $10 par common stock for the net assets ofMarcus Incorporated on December 31, 2012. The stock has a fair value of $65 per share. Acquisition costs are $10,000, and the cost of issuing the stock is $3,000. At the time of the purchase, Marcus had the following summarized balance sheet:

The only fair value differing from book value is equipment, which is worth $350,000. Marcus has $180,000 in operating losses in prior years. The previous asset values are also the tax basis of the assets, which will be the tax basis for Hanson, since the acquisition is a tax-free exchange. Hanson is confident that it will recover the entire tax loss carryforward applicable to the past losses ofMarcus. The applicable tax rate is 30%.

Record the acquisition of the net assets of Marcus Incorporated by Hanson Company. You may assume the price paid will allow goodwill to be recorded. Use value analysis to support your solution.

The only fair value differing from book value is equipment, which is worth $350,000. Marcus has $180,000 in operating losses in prior years. The previous asset values are also the tax basis of the assets, which will be the tax basis for Hanson, since the acquisition is a tax-free exchange. Hanson is confident that it will recover the entire tax loss carryforward applicable to the past losses ofMarcus. The applicable tax rate is 30%.

Record the acquisition of the net assets of Marcus Incorporated by Hanson Company. You may assume the price paid will allow goodwill to be recorded. Use value analysis to support your solution.

التوضيح

Calculated deferred tax liability :

It i...

Advanced Accounting 11th Edition by Paul Fischer,William Tayler, Rita Cheng

لماذا لم يعجبك هذا التمرين؟

أخرى 8 أحرف كحد أدنى و 255 حرفاً كحد أقصى

حرف 255