Advanced Accounting 11th Edition by Paul Fischer,William Tayler, Rita Cheng

النسخة 11الرقم المعياري الدولي: 978-0538480284

Advanced Accounting 11th Edition by Paul Fischer,William Tayler, Rita Cheng

النسخة 11الرقم المعياري الدولي: 978-0538480284 تمرين 27

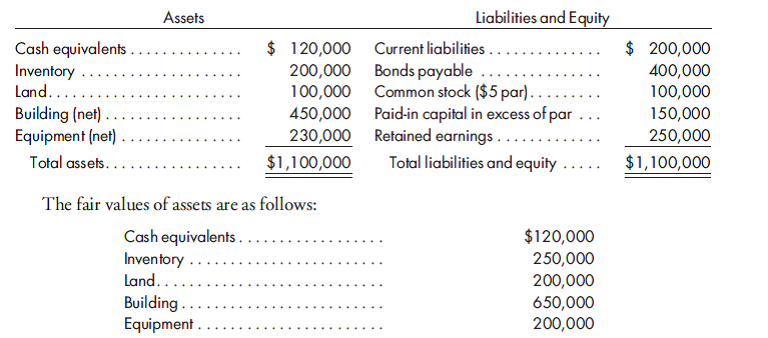

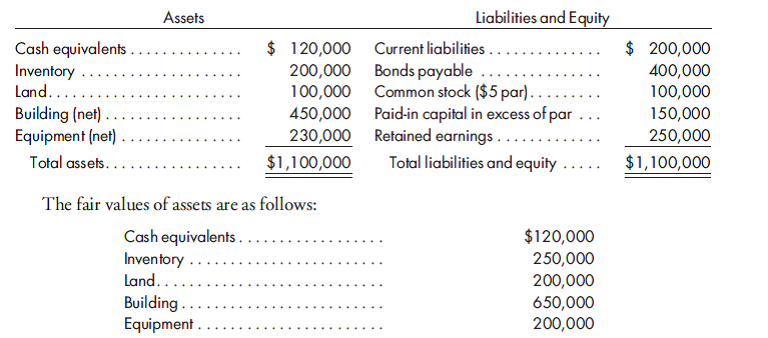

80% purchase, alternative values for goodwill. Quail Company purchases 80% of the common stock of Commo Company for $800,000. At the time of the purchase, Commo has the following balance sheet:

1. Prepare the value analysis schedule and the determination and distribution of excess schedule under three alternatives for valuing the NCI:

a. The value of the NCI is implied by the price paid by the parent for the controlling interest.

b. The market value of the shares held by the NCI is $45 per share.

c. The international accounting option, which does not allow goodwill to be recorded as part of the NCI, is used.

2. Prepare the elimination entries that would be made on a consolidated worksheet prepared on the date of purchase under the three alternatives for valuing the NCI:

a. The value of the NCI is implied by the price paid by the parent for the controlling interest.

b. The market value of the shares held by the NCI is $45 per share.

c. The international accounting option, which does not allow goodwill to be recorded as part of the NCI, is used.

1. Prepare the value analysis schedule and the determination and distribution of excess schedule under three alternatives for valuing the NCI:

a. The value of the NCI is implied by the price paid by the parent for the controlling interest.

b. The market value of the shares held by the NCI is $45 per share.

c. The international accounting option, which does not allow goodwill to be recorded as part of the NCI, is used.

2. Prepare the elimination entries that would be made on a consolidated worksheet prepared on the date of purchase under the three alternatives for valuing the NCI:

a. The value of the NCI is implied by the price paid by the parent for the controlling interest.

b. The market value of the shares held by the NCI is $45 per share.

c. The international accounting option, which does not allow goodwill to be recorded as part of the NCI, is used.

التوضيح

Value analysis schedule:

The value anal...

Advanced Accounting 11th Edition by Paul Fischer,William Tayler, Rita Cheng

لماذا لم يعجبك هذا التمرين؟

أخرى 8 أحرف كحد أدنى و 255 حرفاً كحد أقصى

حرف 255