Advanced Accounting 11th Edition by Paul Fischer,William Tayler, Rita Cheng

النسخة 11الرقم المعياري الدولي: 978-0538480284

Advanced Accounting 11th Edition by Paul Fischer,William Tayler, Rita Cheng

النسخة 11الرقم المعياري الدولي: 978-0538480284 تمرين 21

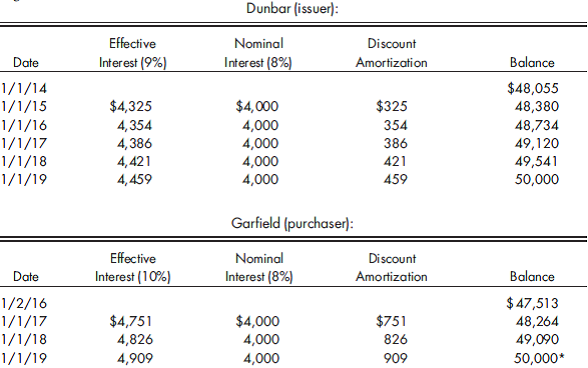

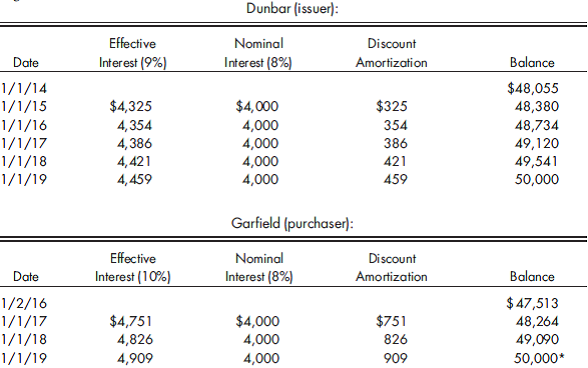

Bond eliminations, effective interest. On January 1, 2014, Dunbar Corporation, an 85%-owned subsidiary of Garfield Industries, received $48,055 for $50,000 of 8%, 5-year bonds it issued when the market rate was 9%. When Garfield Industries purchased these bonds for $47,513 on January 2, 2016, the market rate was 10%. Given the following effective interest amortization schedules for both companies, calculate the gain or loss on retirement and the interest adjustments to the issuer's income distribution schedules over the remaining term of the bonds.

التوضيح

Therefore, the gain on retirem...

Advanced Accounting 11th Edition by Paul Fischer,William Tayler, Rita Cheng

لماذا لم يعجبك هذا التمرين؟

أخرى 8 أحرف كحد أدنى و 255 حرفاً كحد أقصى

حرف 255