Advanced Accounting 11th Edition by Paul Fischer,William Tayler, Rita Cheng

النسخة 11الرقم المعياري الدولي: 978-0538480284

Advanced Accounting 11th Edition by Paul Fischer,William Tayler, Rita Cheng

النسخة 11الرقم المعياري الدولي: 978-0538480284 تمرين 19

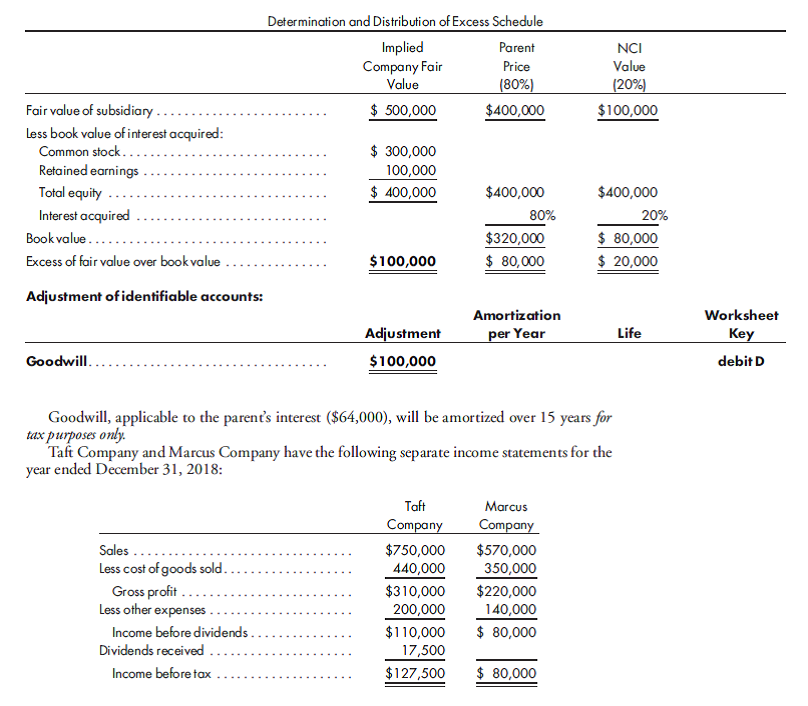

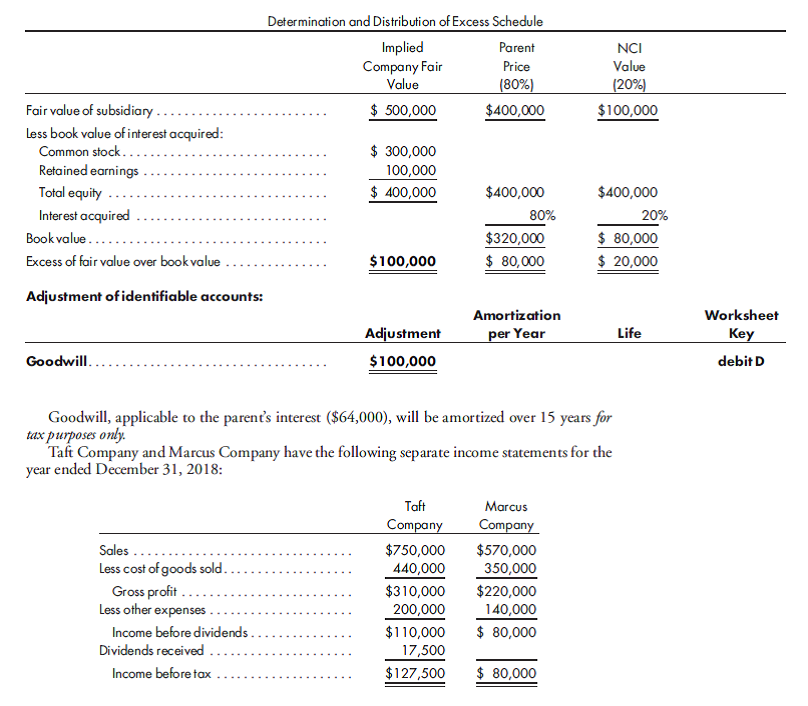

Taxation as consolidated company. On May 1, 2016, Taft Company acquires a 80% interest in Marcus Company for $400,000. The fair value of the NCI is $100,000. The following determination and distribution of excess schedule is prepared:

During 2018,Marcus Company pays cash dividends of $25,000.

Prepare the entry to record income tax payable on each company's books. Assume a 30% corporate income tax rate.

During 2018,Marcus Company pays cash dividends of $25,000.

Prepare the entry to record income tax payable on each company's books. Assume a 30% corporate income tax rate.

التوضيح

Journal entry in the books of M company ...

Advanced Accounting 11th Edition by Paul Fischer,William Tayler, Rita Cheng

لماذا لم يعجبك هذا التمرين؟

أخرى 8 أحرف كحد أدنى و 255 حرفاً كحد أقصى

حرف 255