Advanced Accounting 11th Edition by Paul Fischer,William Tayler, Rita Cheng

النسخة 11الرقم المعياري الدولي: 978-0538480284

Advanced Accounting 11th Edition by Paul Fischer,William Tayler, Rita Cheng

النسخة 11الرقم المعياري الدولي: 978-0538480284 تمرين 24

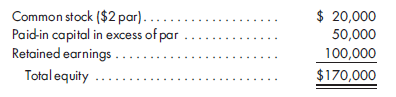

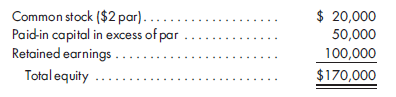

Consolidated income statement, affiliated firm for tax. On January 1, 2011, Delta Corporation exchanges 12,000 shares of its common stock for an 80% interest in Morgan Company. The stock issued has a par value of $10 per share and a fair value of $20 per share. On the date of purchase,Morgan has the following balance sheet:

On the purchase date, Morgan has equipment with an 8-year remaining life that is undervalued by $20,000. Any remaining excess cost is attributed to goodwill.

There are intercompany merchandise sales. During 2012, Delta sells $20,000 of merchandise to Morgan. Morgan sells $30,000 of merchandise to Delta. Morgan has $2,000 of Delta goods in its beginning inventory and $4,200 of Delta goods in its ending inventory. Delta has $2,500 of Morgan goods in its beginning inventory and $3,000 of Morgan goods in its ending inventory. Delta's gross profit rate is 40%;Morgan's is 25%.

On July 1, 2011, Delta sells a machine to Morgan for $90,000. The book value of the machine on Delta's books is $50,000 at the time of the sale. The machine has a 5-year remaining life. Depreciation on the machine is included in expenses.

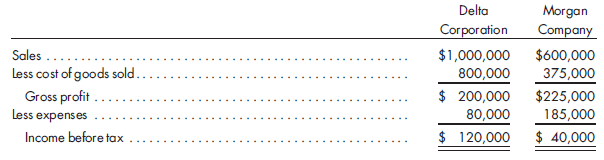

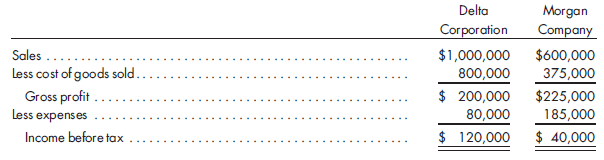

The consolidated group meets the requirements of an affiliated group under the tax law and files a consolidated tax return. The original purchase is not structured as a nontaxable exchange. Delta uses the cost method to record its investment in Morgan. Since Morgan has never paid dividends, Delta has not recorded any income on its investment in Morgan. The two companies prepare the following income statements for 2012:

Prepare a determination and distribution of excess schedule. Prepare the 2012 consolidated net income in schedule form. Include eliminations and adjustments. Provide income distribution schedules to allocate consolidated net income to the controlling and noncontrolling interests.

On the purchase date, Morgan has equipment with an 8-year remaining life that is undervalued by $20,000. Any remaining excess cost is attributed to goodwill.

There are intercompany merchandise sales. During 2012, Delta sells $20,000 of merchandise to Morgan. Morgan sells $30,000 of merchandise to Delta. Morgan has $2,000 of Delta goods in its beginning inventory and $4,200 of Delta goods in its ending inventory. Delta has $2,500 of Morgan goods in its beginning inventory and $3,000 of Morgan goods in its ending inventory. Delta's gross profit rate is 40%;Morgan's is 25%.

On July 1, 2011, Delta sells a machine to Morgan for $90,000. The book value of the machine on Delta's books is $50,000 at the time of the sale. The machine has a 5-year remaining life. Depreciation on the machine is included in expenses.

The consolidated group meets the requirements of an affiliated group under the tax law and files a consolidated tax return. The original purchase is not structured as a nontaxable exchange. Delta uses the cost method to record its investment in Morgan. Since Morgan has never paid dividends, Delta has not recorded any income on its investment in Morgan. The two companies prepare the following income statements for 2012:

Prepare a determination and distribution of excess schedule. Prepare the 2012 consolidated net income in schedule form. Include eliminations and adjustments. Provide income distribution schedules to allocate consolidated net income to the controlling and noncontrolling interests.

التوضيح

Subsidiary company tax schedule

Calcula...

Advanced Accounting 11th Edition by Paul Fischer,William Tayler, Rita Cheng

لماذا لم يعجبك هذا التمرين؟

أخرى 8 أحرف كحد أدنى و 255 حرفاً كحد أقصى

حرف 255