Advanced Accounting 11th Edition by Paul Fischer,William Tayler, Rita Cheng

النسخة 11الرقم المعياري الدولي: 978-0538480284

Advanced Accounting 11th Edition by Paul Fischer,William Tayler, Rita Cheng

النسخة 11الرقم المعياري الدولي: 978-0538480284 تمرين 14

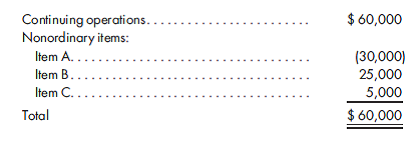

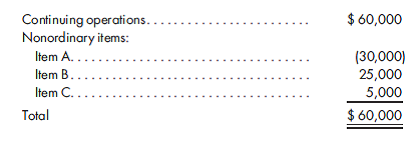

Ratable allocation for nonordinary items. Baxter Corporation anticipated pretax values for the current year as follows:

The statutory tax rates are as follows: 15% on the first $50,000, 25% on the next $25,000, 34% on the next $25,000, and 39% on amounts in excess of $100,000.

Determine the tax expense traceable to nonordinary items B and C.

The statutory tax rates are as follows: 15% on the first $50,000, 25% on the next $25,000, 34% on the next $25,000, and 39% on amounts in excess of $100,000.

Determine the tax expense traceable to nonordinary items B and C.

التوضيح

Calculation of tax expenses to non-ordin...

Advanced Accounting 11th Edition by Paul Fischer,William Tayler, Rita Cheng

لماذا لم يعجبك هذا التمرين؟

أخرى 8 أحرف كحد أدنى و 255 حرفاً كحد أقصى

حرف 255