Advanced Accounting 11th Edition by Paul Fischer,William Tayler, Rita Cheng

النسخة 11الرقم المعياري الدولي: 978-0538480284

Advanced Accounting 11th Edition by Paul Fischer,William Tayler, Rita Cheng

النسخة 11الرقم المعياري الدولي: 978-0538480284 تمرين 11

Journal entries, statement of revenue expenditures , and change in fund balance. On July 1, 2018, the beginning of its fiscal year, the trial balance of the general fund of the city of Went worth was as follows:

The following events occurred:

a. The budget shows estimated general fund revenues of $400,000 and estimated expenditures (including $16,000 encumbered in the prior year) of $362,000.

b. In July, the item ordered in the previous year was received at an invoice cost of $16,400. A voucher is prepared.

c. Property taxes amounting to $300,000 were levied, with 4% estimated to be uncollectible.

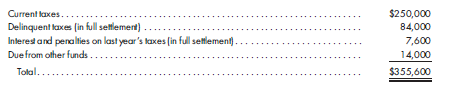

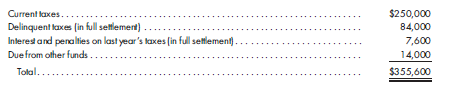

d. Cash collections during the year were as follows:

The controller wishes variations in estimates to be recorded in the appropriate revenue or expenditure account.

e. Purchase orders totaling $276,000 were placed. Later, invoices for $260,000 were received and vouchered; supplies inventory purchases were $16,000 of the total. The purchase covered $254,000 of the encumbrances.

f. Payrolls of $50,000 were paid. (Ignore payroll taxes and other deductions.) In addition, vouchers totaling $280,000 were paid.

g. An automobile was purchased for the fire department. It cost $16,000 and was not previously encumbered. The invoice is vouchered.

h. At year-end, $6,000 in supplies was on hand. There were no supplies on hand a year ago. The city wishes to show the inventory and to establish a proper fund balance designation.

1. Prepare journal entries that would be made in the general fund for the above events.

2. Prepare closing entries.

3. Prepare a statement of revenues, expenditures, and changes in fund balance.

The following events occurred:

a. The budget shows estimated general fund revenues of $400,000 and estimated expenditures (including $16,000 encumbered in the prior year) of $362,000.

b. In July, the item ordered in the previous year was received at an invoice cost of $16,400. A voucher is prepared.

c. Property taxes amounting to $300,000 were levied, with 4% estimated to be uncollectible.

d. Cash collections during the year were as follows:

The controller wishes variations in estimates to be recorded in the appropriate revenue or expenditure account.

e. Purchase orders totaling $276,000 were placed. Later, invoices for $260,000 were received and vouchered; supplies inventory purchases were $16,000 of the total. The purchase covered $254,000 of the encumbrances.

f. Payrolls of $50,000 were paid. (Ignore payroll taxes and other deductions.) In addition, vouchers totaling $280,000 were paid.

g. An automobile was purchased for the fire department. It cost $16,000 and was not previously encumbered. The invoice is vouchered.

h. At year-end, $6,000 in supplies was on hand. There were no supplies on hand a year ago. The city wishes to show the inventory and to establish a proper fund balance designation.

1. Prepare journal entries that would be made in the general fund for the above events.

2. Prepare closing entries.

3. Prepare a statement of revenues, expenditures, and changes in fund balance.

التوضيح

a2) • Encumbrance account is transfer t...

Advanced Accounting 11th Edition by Paul Fischer,William Tayler, Rita Cheng

لماذا لم يعجبك هذا التمرين؟

أخرى 8 أحرف كحد أدنى و 255 حرفاً كحد أقصى

حرف 255