Intermediate Microeconomics and Its Application 12th Edition by Walter Nicholson,Christopher Snyder

النسخة 12الرقم المعياري الدولي: 978-1133189022

Intermediate Microeconomics and Its Application 12th Edition by Walter Nicholson,Christopher Snyder

النسخة 12الرقم المعياري الدولي: 978-1133189022 تمرين 27

An Experiment in Health Insurance

The provision of health insurance is one of the most universal and expensive social policies throughout the world. National health insurance schemes can range from completely government-controlled enterprises (the National Health Service in the United Kingdom) to quite complex combinations of government and private insurance (the United States). In recent years most nations have experienced sharply rising costs for these schemes, and this has led to a number of reforms such as the passage of the Affordable Care Act in 2009 in the United States. To evaluate whether such changes will have any impact on reigning in costs, it is important to understand the problems that all health insurance programs encounter.

Moral Hazard

One such important problem is that insurance coverage of health care needs tends to increase the demand for services. Because insured patients pay only a small fraction of the costs of the services they receive, they will demand more than they would have if they had to pay market prices. This tendency of insurance coverage to increase demand is (perhaps unfortunately) called "moral hazard," though there is nothing especially immoral about such behavior.

The Rand Experiment

The Medicare program was introduced in the United States in 1965, and the increase in demand for medical services by the elderly was immediately apparent. In order to understand better the factors that were leading to this increase in demand, the government funded a large-scale experiment in four cities. In that experiment, which was conducted by the Rand Corporation, people were assigned to different insurance plans that varied in the fraction of medical costs that people would have to pay out of their own pockets for medical care.1 In insurance terms, the experiment varied the "coinsurance" rate from zero (free care) to nearly 100 percent (patients pay everything).

Results of the Experiment

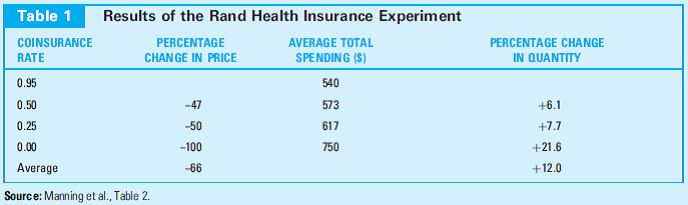

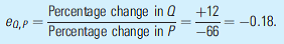

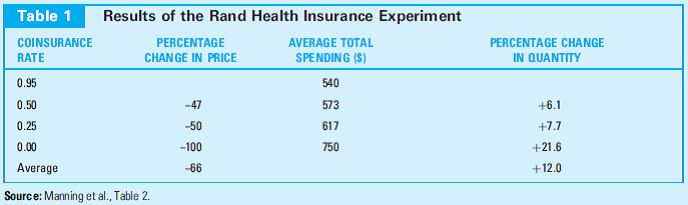

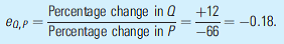

Table 1 shows the results from the experiment. People who faced lower out-of-pocket costs for medical care tended to demand more of it. A rough estimate of the elasticity of demand can be obtained by averaging the percentage changes across the various plans in the table. That is,

So, as might have been expected, the demand for medical care is inelastic, but it clearly is not zero. In fact, the Rand study found much larger price effects for some specific medical services such as mental health care and dental care. It is these kinds of services for which new insurance coverage would be expected to have the greatest impact on market demand.

Three ways to mitigate the effects of moral hazard on the demand for medical care are:

• Inclusion of provisions that require people to pay a portion of their medical expenses (coinsurance and deductibles);

• Incentives to get physicians to take costs into account when treating patients; and

• Limits on the quantities of certain medical treatments that people can consume.

What role, if any, do these provisions play in the Affordable Care Act (or in any other reform of national health insurance with which you are familiar)?

The provision of health insurance is one of the most universal and expensive social policies throughout the world. National health insurance schemes can range from completely government-controlled enterprises (the National Health Service in the United Kingdom) to quite complex combinations of government and private insurance (the United States). In recent years most nations have experienced sharply rising costs for these schemes, and this has led to a number of reforms such as the passage of the Affordable Care Act in 2009 in the United States. To evaluate whether such changes will have any impact on reigning in costs, it is important to understand the problems that all health insurance programs encounter.

Moral Hazard

One such important problem is that insurance coverage of health care needs tends to increase the demand for services. Because insured patients pay only a small fraction of the costs of the services they receive, they will demand more than they would have if they had to pay market prices. This tendency of insurance coverage to increase demand is (perhaps unfortunately) called "moral hazard," though there is nothing especially immoral about such behavior.

The Rand Experiment

The Medicare program was introduced in the United States in 1965, and the increase in demand for medical services by the elderly was immediately apparent. In order to understand better the factors that were leading to this increase in demand, the government funded a large-scale experiment in four cities. In that experiment, which was conducted by the Rand Corporation, people were assigned to different insurance plans that varied in the fraction of medical costs that people would have to pay out of their own pockets for medical care.1 In insurance terms, the experiment varied the "coinsurance" rate from zero (free care) to nearly 100 percent (patients pay everything).

Results of the Experiment

Table 1 shows the results from the experiment. People who faced lower out-of-pocket costs for medical care tended to demand more of it. A rough estimate of the elasticity of demand can be obtained by averaging the percentage changes across the various plans in the table. That is,

So, as might have been expected, the demand for medical care is inelastic, but it clearly is not zero. In fact, the Rand study found much larger price effects for some specific medical services such as mental health care and dental care. It is these kinds of services for which new insurance coverage would be expected to have the greatest impact on market demand.

Three ways to mitigate the effects of moral hazard on the demand for medical care are:

• Inclusion of provisions that require people to pay a portion of their medical expenses (coinsurance and deductibles);

• Incentives to get physicians to take costs into account when treating patients; and

• Limits on the quantities of certain medical treatments that people can consume.

What role, if any, do these provisions play in the Affordable Care Act (or in any other reform of national health insurance with which you are familiar)?

التوضيح

One of the examples health insurance pla...

Intermediate Microeconomics and Its Application 12th Edition by Walter Nicholson,Christopher Snyder

لماذا لم يعجبك هذا التمرين؟

أخرى 8 أحرف كحد أدنى و 255 حرفاً كحد أقصى

حرف 255