Intermediate Microeconomics and Its Application 12th Edition by Walter Nicholson,Christopher Snyder

النسخة 12الرقم المعياري الدولي: 978-1133189022

Intermediate Microeconomics and Its Application 12th Edition by Walter Nicholson,Christopher Snyder

النسخة 12الرقم المعياري الدولي: 978-1133189022 تمرين 27

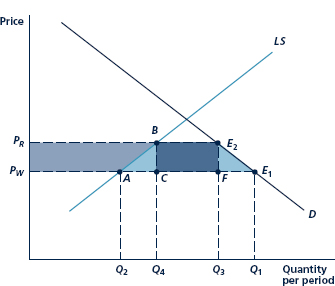

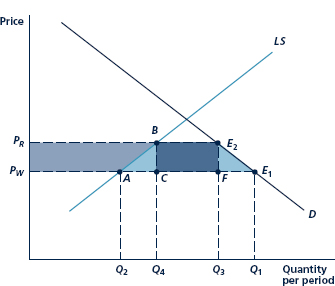

Use Figure to answer the following questions about the imposition of a tariff on a com-petitive industry.

1. Do domestic producers pay any of this tax? Do foreign producers pay any of this tax?

2. Who gains the increase in producer surplus that results from the tariff?

3. Are the sources of the deadweight losses represented by triangles ABC and E2E1F different? Explain.

FIGURE Effects of a Tariff

Imposition of a tariff of amount t raises price to P R ¼ P W + t. This results in collection of tariff revenue (darkest), a transfer from consumers to producers (dark), and two triangles measuring deadweight loss (light). A quota has similar effects, though in this case no revenues are collected.

1. Do domestic producers pay any of this tax? Do foreign producers pay any of this tax?

2. Who gains the increase in producer surplus that results from the tariff?

3. Are the sources of the deadweight losses represented by triangles ABC and E2E1F different? Explain.

FIGURE Effects of a Tariff

Imposition of a tariff of amount t raises price to P R ¼ P W + t. This results in collection of tariff revenue (darkest), a transfer from consumers to producers (dark), and two triangles measuring deadweight loss (light). A quota has similar effects, though in this case no revenues are collected.

التوضيح

1) Domestic producers will pay none of t...

Intermediate Microeconomics and Its Application 12th Edition by Walter Nicholson,Christopher Snyder

لماذا لم يعجبك هذا التمرين؟

أخرى 8 أحرف كحد أدنى و 255 حرفاً كحد أقصى

حرف 255