Engineering Economy 7th Edition by Leland Blank ,Anthony Tarquin

النسخة 7الرقم المعياري الدولي: 978-0073376301

Engineering Economy 7th Edition by Leland Blank ,Anthony Tarquin

النسخة 7الرقم المعياري الدولي: 978-0073376301 تمرين 23

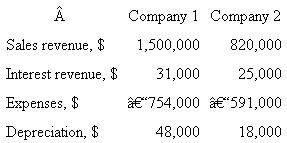

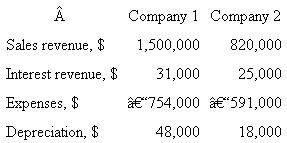

Two companies have the following values on their annual tax returns.

a) Calculate the federal income tax for the year for each company.

b) Determine the percent of sales revenue each company will pay in federal income tax.

c) Estimate the taxes using an effective rate of 34% of the entire TI. Determine the percentage error made relative to the exact taxes in part

a).

a) Calculate the federal income tax for the year for each company.

b) Determine the percent of sales revenue each company will pay in federal income tax.

c) Estimate the taxes using an effective rate of 34% of the entire TI. Determine the percentage error made relative to the exact taxes in part

a).

التوضيح

Net operating income is gross income min...

Engineering Economy 7th Edition by Leland Blank ,Anthony Tarquin

لماذا لم يعجبك هذا التمرين؟

أخرى 8 أحرف كحد أدنى و 255 حرفاً كحد أقصى

حرف 255